by Calculated Risk on 2/07/2011 03:00:00 PM

Monday, February 07, 2011

Consumer Credit increases in December

The Federal Reserve reports:

Consumer credit increased at an annual rate of 2-1/2 percent in the fourth quarter. Revolving credit declined at an annual rate of 2-3/4 percent,

and nonrevolving credit increased at an annual rate of 5-1/2 percent. In December, consumer credit increased 3 percent at an annual rate.

Click on graph for larger image in graph gallery.

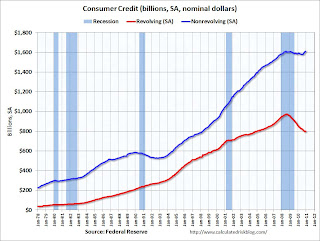

Click on graph for larger image in graph gallery.This graph shows consumer credit since 1978. The amounts are nominal (not inflation adjusted).

Revolving credit (credit card debt) is off 17.8% from the peak. Non-revolving debt (auto, furniture, and other loans) is now slightly above the old peak. Note: Consumer credit does not include real estate debt.

Both revolving and non-revolving credit were up slightly in December. This was the first increase in revolving credit since August 2008 following 27 consecutive months of declines. This fits with the recent Senior Loan Officer survey that showed:

Banks again reported an increased willingness to make consumer installment loans, and a small net fraction of respondents reported easing standards for approving consumer credit card applications.