by Calculated Risk on 3/12/2011 11:21:00 AM

Saturday, March 12, 2011

Summary for Week ending March 11th

My thoughts are with the Japanese today.

There are several downside risks for the U.S. economy including high oil prices and the possibility of a supply disruption, spillover from the European financial crisis, cutbacks at the state and local government level, drag from Federal government fiscal policy, ongoing housing issues and inflation concerns. I am watching all of these issues and I'll touch on a few today ...

As expected, the European financial crisis is now front page news again. The debt ratings for both Greece and Spain were lowered again this week, and there was speculation that Portugal would seek a bailout soon. As a result, the yields on government bonds for Ireland, Greece, Portugal and several other European countries moved higher again this week. However, late Friday night, the Euro-zone leaders reached agreement to provide additional support for certain countries (here is the text of the agreement).

The Middle East and North Africa remain unsettled, with a civil war in Libya. There were large demonstrations in Yemen last night that ended with protestors being shot. However, the so-called “Day of rage” in Saudi Arabia barely materialized.

U.S. oil prices declined slightly to $101 per barrel on Friday. This is up about 20% compared to last March, and the increase in oil prices contributed to a higher trade deficit in January (see below), and probably contributed to the decline in consumer sentiment in the preliminary March Reuters / University of Michigan survey (graph below).

There were also two key housing reports last week. CoreLogic reported that 11.1 million residential properties with a mortgage were in negative equity at the end of Q4 (23.1% of properties with a mortgage), and they also reported that house prices were at a new post-bubble low in January.

On the positive side, retail sales were solid in February – and sales in January were revised up. Also small business optimism improved slightly in February.

Below is a summary of economic data last week mostly in graphs:

• Retail Sales increased 1.0% in February

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

On a monthly basis, retail sales increased 1.0% from January to February(seasonally adjusted, after revisions), and sales were up 8.9% from February 2010. The December 2010 to January 2011 percent change was revised from +0.3% to +0.7%. This was at expectations, and including the upward revision to January retail sales, this was a solid report.

• Trade Deficit increased in January to $46.3 billion

The Department of Commerce reported exports were up sharply, but imports surged in January. "January exports were $4.4 billion more than December exports of $163.3 billion. January imports were $10.5 billion more than December imports of $203.6 billion."

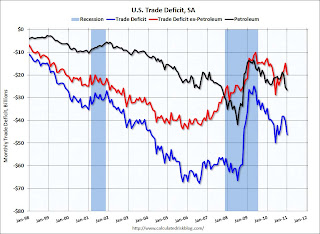

This graph shows the U.S. trade deficit, with and without petroleum, through January.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The petroleum deficit increased in January as both quantity and import prices continued to rise - averaging $84.34 in January, up from $79.78 in December. Prices will be even higher in February and March. The trade deficit with China was $23.3 billion (NSA) in January. Once again oil and China deficits are essentially the entire trade deficit (or even more).

• CoreLogic: House Prices declined 2.5% in January, Prices at New Post-bubble low

From CoreLogic: CoreLogic® Home Price Index Shows Year-Over-Year Decline for Sixth Straight Month

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 5.7% over the last year, and off 32.8% from the peak.

This is the sixth straight month of year-over-year declines, and the seventh straight month of month-to-month declines. The index is now 1.6% below the previous post-bubble low set in March 2009, and I expect to see further new post-bubble lows for this index over the next few months.

• CoreLogic: 11.1 Million U.S. Properties with Negative Equity in Q4

CoreLogic released the Q4 2010 negative equity report this week "showing that 11.1 million, or 23.1 percent, of all residential properties with a mortgage were in negative equity at the end of the fourth quarter of 2010, up from 10.8 million, or 22.5 percent, in the third quarter. Here are a couple of graphs from the report:

This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home.

This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home.

About 10% of homeowners with mortgages have more than 25% negative equity.

The second graph from CoreLogic shows the aggregate dollar volume by percent of negative equity. Of the $751 billion in negative equity in Q4, over $450 billion of the aggregate negative equity dollars are for borrowers who are upside down by more than 50%. Just under $200 billion more is for borrowers who have 25% to 50% negative equity.

The second graph from CoreLogic shows the aggregate dollar volume by percent of negative equity. Of the $751 billion in negative equity in Q4, over $450 billion of the aggregate negative equity dollars are for borrowers who are upside down by more than 50%. Just under $200 billion more is for borrowers who have 25% to 50% negative equity.

All of these borrowers are at high risk for foreclosure.

The third graph shows the break down of equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming.

The third graph shows the break down of equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming.

In Nevada, over 65% of homeowners with mortgages owe more than their homes are worth. Arizona and Florida are around 50%. Michigan, Georgia and California are all over 30%.

• NFIB: Small Business Optimism Index increases in February

From National Federation of Independent Business (NFIB): NFIB Small Business Optimism Index -- Slow and Steady: Continues Gradual Rise in February

From National Federation of Independent Business (NFIB): NFIB Small Business Optimism Index -- Slow and Steady: Continues Gradual Rise in February

This graph shows the small business optimism index since 1986. The index increased to 94.5 in February from 94.1 in January.

Although still fairly low, this is the highest level for the index since December 2007.

• Q4 Flow of Funds: Household Real Estate assets off $6.3 trillion from peak

The Federal Reserve released the Q4 2010 Flow of Funds report this week: Flow of Funds.

Here are a couple of graphs based on data in the report:

This is the Households and Nonprofit net worth as a percent of GDP.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles.

The next graph shows household real estate assets and mortgage debt as a percent of GDP.

The next graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt has now declined by $542 billion from the peak. Studies suggest most of the decline in debt has been because of defaults, but some of the decline is from homeowners paying down debt.

Assets prices, as a percent of GDP, have fallen significantly and are only slightly above historical levels. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

• Consumer Sentiment declines sharply in March

The preliminary March Reuters / University of Michigan consumer sentiment index declined to 68.2 from 77.5 in February, the lowest level since October 2010. This was well below the consensus forecast of 76.5.

The preliminary March Reuters / University of Michigan consumer sentiment index declined to 68.2 from 77.5 in February, the lowest level since October 2010. This was well below the consensus forecast of 76.5.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

My initial guess is this decline was because of higher gasoline prices.

• Other Economic Stories ...

• BLS: Job Openings decline in January, Low Labor Turnover

• From Jon Hilsenrath at the WSJ: Fed Unlikely to Remove Its Economic Stimulus Just Yet

• From MarketWatch: Moody’s cuts Greece rating, stokes debt fears

• From Bloomberg: Portugal 5-Year Yield at Euro-Era Record on Bailout Speculation

• From Bloomberg: Spain's Rating Downgraded to Aa2 by Moody's Over Bank Cost Concerns

• AAR: Rail Traffic increases in February compared to February 2010.

• Ceridian-UCLA: February PCI Continues to Signal Slow Growth

• From Chris Foote, Kris Gerardi and Paul Willen at the Atlanta Fed: The seductive but flawed logic of principal reduction

• California Realtors: Only three out of five short sale transactions close

• Unofficial Problem Bank list increases to 964 Institutions

Best wishes to all!