by Calculated Risk on 4/01/2011 10:04:00 AM

Friday, April 01, 2011

Employment Summary and Part Time Workers, Unemployed over 26 Weeks

Note: ISM Manufacturing survey PMI was at PMI at 61.2% in March, down slightly from 61.4% in February. This is very strong. Here is the report - (I'll post a graph later).

Here are a few more graphs based on the employment report ...

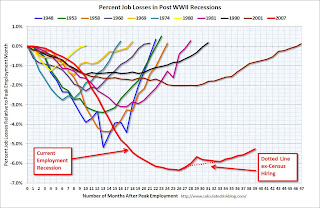

Percent Job Losses During Recessions

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at the start of the recession.

In the previous post, the graph showed the job losses aligned at maximum job losses.

In terms of lost payroll jobs, the 2007 recession is by far the worst since WWII, and the "recovery" for payroll jobs is one of the slowest.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in March, at 8.4 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased slightly to 8.43 million in March from 8.34 million in February.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 15.7% in March from 15.9% in February. Still very high, but improving.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 6.122 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 5.993 million in February. This remains very high, and is one of the defining features of this employment recession.

Summary

This was an OK report; a little better than most recent reports, but still a long ways to go.

If we average the last three months together that gives about 160,000 payroll jobs per month. That is more than enough to keep up with the growth in the labor force, but it will only push the unemployment rate down slowly. Private payrolls were a little better at an average of 188,000 per month, as state and local governments continued to lay off workers (something we expect all year).

The decline in the unemployment rate from 8.9% to 8.8%, was good news, especially since the participation rate was unchanged at 64.2%. Note: This is the percentage of the working age population in the labor force.

However the increases for the long term unemployed, and for the number of part time workers for economic reasons, was not welcome news - although U-6 declined to 15.7%. All of these levels are very high.

The average workweek declined slightly to 34.1 hours, and average hourly earnings was flat. Both very disappointing.

Overall this was another small step in the right direction.

• Earlier Employment post: March Employment Report: 216,000 Jobs, 8.8% Unemployment Rate