by Calculated Risk on 4/06/2011 07:15:00 AM

Wednesday, April 06, 2011

MBA: Mortgage Purchase Application activity increases ahead of FHA fee increase

The MBA reports: Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 6.2 percent to its lowest level since February 25, 2011, on a seasonally adjusted basis. The seasonally adjusted Purchase Index increased 6.7 percent to its highest level of the year

...

“Purchase application volume increased last week reaching the highest level of the year, but remains relatively low by historical standards, at levels last seen in 1997,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “The increase last week was due to a sharp increase in applications for government loans. Borrowers were likely motivated to apply before a scheduled increase in FHA insurance premiums that became effective last Friday.” Fratantoni continued, “Rates were flat last week, but refinance activity fell, as the pool of borrowers who have both the incentive and the ability to qualify for a refinance continues to shrink.”

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.93 percent from 4.92 percent, with points decreasing to 0.70 from 0.83 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

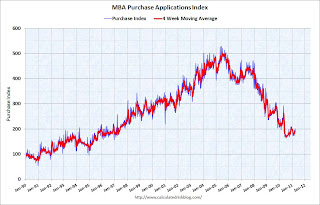

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

As Fratantoni noted, this was the highest level of purchase activity this year - but activity is still at 1997 levels. It appears that the increase in purchase activity was related to the increase in FHA insurance premiums, and activity will probably decline this week.