by Calculated Risk on 5/07/2011 11:51:00 AM

Saturday, May 07, 2011

Summary for Week ending May 6th

This was a busy week and the data was mixed. Let’s start with employment:

The BLS reported that payroll employment increased 244,000 in April and that the unemployment rate increased to 9.0%. So far the economy has added 854,000 private sector jobs this year, or 213,500 per month. There have been 768,000 total non-farm jobs added this year or 192,000 per month.

This pace of job growth is just more than enough to keep up with the growth in the labor force, so it has pushed down the unemployment rate slowly this year. The unemployment rate has declined from 9.4% in December 2010 to 9.0% in April.

Overall this was another small step in the right direction for payroll jobs, but this report reminds us that unemployment and underemployment are critical problems in the U.S. There are 6.955 million fewer payroll jobs now than before the recession started in 2007 with 13.75 million Americans currently unemployed. Another 8.6 million are working part time for economic reasons, and about 4 million more workers have left the labor force. Of those unemployed, 5.8 million have been unemployed for six months or more. Clearly the overall employment situation remains grim.

I’ve argued that oil and gasoline prices are the biggest downside risk to the economy. If so, this was a great week as WTI oil prices plunged to $97.18 per barrel, from $113.39 a week ago. Brent crude futures were down from almost $127 per barrel to $109 per barrel. Of course a key reason for the decline was evidence of demand destruction – suggesting high prices are impacting consumer spending and behavior.

Other data was mixed. The ISM manufacturing index remained strong, but the ISM non-manufacturing index indicated sharply slower expansion. Auto sales were above expectations (although sales will probably slow due to supply disruption issues) and same store retail reports were positive.

According to Clear Capital, house prices are now at new post bubble lows, and Fannie and Freddie reported record REO sales in Q1 (and are now foreclosing again). Europe remains a key risk. Portugal has agreed to a bailout, and Greece is struggling to avoid restructuring their debt.

Overall it appears the recovery is continuing, but at a sluggish pace.

Below is a summary of economic data last week mostly in graphs:

• April Employment Report: 244,000 Jobs, 9.0% Unemployment Rate

The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The unemployment rate increased to 9.0% (red line).

The Labor Force Participation Rate was unchanged at 64.2% in April (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio decreased slightly to 58.4% in April (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The current employment recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

In general, all four categories are trending down, although the "less than 5 weeks" category increased this month. Note that the "less than 5 weeks" used to be much higher, even during periods of strong job growth.

• ISM Manufacturing at 60.4 in April

From the Institute for Supply Management: April 2011 Manufacturing ISM Report On Business®

PMI at 60.4% in April, down from 61.2% in March. The employment index was at 62.7 and new orders at 61.7. All slightly slower than in March, but still very strong.

PMI at 60.4% in April, down from 61.2% in March. The employment index was at 62.7 and new orders at 61.7. All slightly slower than in March, but still very strong.

Here is a long term graph of the ISM manufacturing index.

This was a strong report and above expectations of 59.5%.

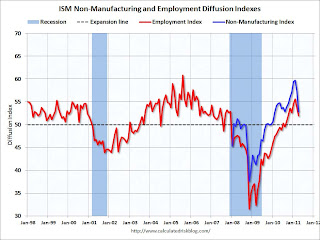

• ISM Non-Manufacturing Index indicates sharply slower expansion in April

From the Institute for Supply Management: April 2011 Non-Manufacturing ISM Report On Business®

The April ISM Non-manufacturing index was at 52.8%, down from 57.3% in March. The employment index indicated slower expansion in April at 51.9%, down from 53.7% in March. Note: Above 50 indicates expansion, below 50 contraction.

The April ISM Non-manufacturing index was at 52.8%, down from 57.3% in March. The employment index indicated slower expansion in April at 51.9%, down from 53.7% in March. Note: Above 50 indicates expansion, below 50 contraction.

This was well below expectations of 58.0%.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

• Total Fannie, Freddie, FHA REO inventory declined in Q1, Fannie and Freddie REO Sales at Record Levels

Special Note: Because of late reporting at the FHA, this graph only includes FHA REO through February. Also see: Lawler: Monthly Report to Commissioner Suggests Serious REO Inventory Problem at FHA

The combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA decreased to 287,184 at the end of Q1 (see FHA special note above) from a record 295,307 units at the end of Q4. The REO inventory increased 37% compared to Q1 2010 (year-over-year comparison).

The combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA decreased to 287,184 at the end of Q1 (see FHA special note above) from a record 295,307 units at the end of Q4. The REO inventory increased 37% compared to Q1 2010 (year-over-year comparison).

This graph shows the REO inventory for Fannie, Freddie and FHA through Q1 2011 (FHA through Feb 2011).

Freddie Mac noted REO sales were at record levels in Q1:

REO disposition reached record levels in 1Q 2011 with over 30,000 homes sold, two-thirds of which were sold to owner occupants, or buyers who intend to live in the home.Fannie Mae also sold a record 62,814 REO in Q1, up from 38,095 in Q1 2010 and 185,744 for all of 2010.

• U.S. Light Vehicle Sales 13.2 million SAAR in April

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.17 million SAAR in April. That is up 17% from April 2010, and up 0.8% from the sales rate last month (March 2011).

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.17 million SAAR in April. That is up 17% from April 2010, and up 0.8% from the sales rate last month (March 2011).This graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

This was above the consensus estimate of 13.0 million SAAR.

Note: The Japanese supply chain disruptions will impact sales over the next several months and I expect sales to be below this level for the next 6 months or so.

• Construction Spending increased in March

The Census Bureau reported this week that overall construction spending increased in March compared to February (seasonally adjusted).

The Census Bureau reported this week that overall construction spending increased in March compared to February (seasonally adjusted).This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 66% below the peak in early 2006, and non-residential spending is 40% below the peak in January 2008.

I expect residential spending to pick up a little this year (mostly multifamily) - and residential will probably be above non-residential spending by the end of the year.

• NMHC Quarterly Apartment Survey: Market Conditions Tighten

From the National Multi Housing Council (NMHC): Apartment Sector Sets Records In Market Tightness And Equity Availability, NMHC Market Conditions Survey Finds

This graph shows the quarterly Apartment Tightness Index.

This graph shows the quarterly Apartment Tightness Index.The index has indicated tighter market conditions for the last five quarters and increased to a record 90 in April. A reading above 50 suggests the vacancy rate is falling and / or rents are rising. This data is a survey of large apartment owners only.

Two key points I've made over and over are 1) with falling vacancy rates and rising rents, the number of multi-family starts will pick up sharply this year (but still be well below normal), and 2) this pickup will lead to a positive contribution to GDP and payroll jobs for construction in 2011, the first positive contribution for either since 2005. This survey reinforces both points.

• Clear Capital Home Price Index shows Double Dip

From Clear Capital: Clear Capital® Reports National Double Dip

This is one of several house prices indexes I follow in addition to Case-Shiller and CoreLogic. This is especially interesting this month for two reasons: 1) the index is showing a double dip in house prices, and 2) the graph showing house prices and REO saturation.

This is one of several house prices indexes I follow in addition to Case-Shiller and CoreLogic. This is especially interesting this month for two reasons: 1) the index is showing a double dip in house prices, and 2) the graph showing house prices and REO saturation.These graphs from Clear Capital show their home price index and the percent REO saturation.

We know that a higher percentage of distress sales put downward pressure on house prices, and these graphs make that relationship pretty clear.

Note: REO saturation usually peaks early in the year - so some of the recent increase is seasonal.

• Other Economic Stories ...

• ADP: Private Employment increased by 179,000 in April

• From Bloomberg: Portugal Agrees on Aid Plan With Wider Deficit Targets

• From the Fed April 2011 Senior Loan Officer Opinion Survey on Bank Lending Practices shows banks more willing to make loans.

• Unofficial Problem Bank list at 983 Institutions

Best wishes to all!