by Calculated Risk on 6/11/2011 11:13:00 AM

Saturday, June 11, 2011

Summary for Week Ending June 10th

Last week was a light week for economic data. The trade balance report showed a decline in the April trade deficit as exports hit a new record high and imports declined. On the U.S. housing market, CoreLogic reported that 10.9 million residential properties had negative equity at the end of the first quarter of 2011 (the property owner owed more on their mortgage than the value of the property). These are the property owners most likely to default, especially those with loans greater than 125% of the value of the property.

Also, in a closely watched speech last week, Fed Chairman Ben Bernanke was somewhat downbeat on the U.S. economic outlook.

There will be much more data next week. Below is a summary of economic data last week mostly in graphs:

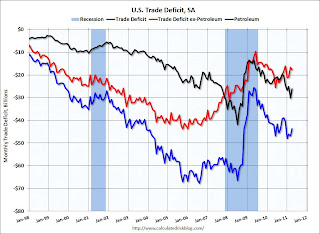

• Trade Deficit decreased to $43.7 billion in April

The first graph shows the monthly U.S. exports and imports in dollars through April 2011.

Click on graph for larger image.

Click on graph for larger image.

Exports increased in April and imports declined (seasonally adjusted). Exports are well above the pre-recession peak and up 19% compared to April 2010; imports are up about 16% compared to April 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through April.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The petroleum deficit decreased in April as the quantity imported decreased sharply even as prices increased. Oil averaged $103.18 per barrel in April, up from $77.13 in April 2010. There is a bit of a lag with prices, but it is possible prices will be a little lower in May.

The trade deficit was smaller than the expected $48.9 billion.

• CoreLogic: 10.9 Million U.S. Properties with Negative Equity in Q1

CoreLogic released the Q1 2011 negative equity report this week.

CoreLogic ... today released negative equity data showing that 10.9 million, or 22.7 percent, of all residential properties with a mortgage were in negative equity at the end of the first quarter of 2011, down slightly from 11.1 million, or 23.1 percent, in the fourth quarter. An additional 2.4 million borrowers had less than five percent equity, referred to as near-negative equity, in the first quarter.Here are a couple of graphs from the report:

This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home.

This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home. Close to 10% of homeowners with mortgages have more than 25% negative equity. This is trending down slowly - the decline is apparently mostly due to homes lost in foreclosure.

The second graph from CoreLogic shows the default rate by percent negative equity.

The second graph from CoreLogic shows the default rate by percent negative equity.The default rate increases the more 'underwater' the property, and the default rate really increases with Loan-to-values (LTV) of 125% or more.

Note that most homes with LTVs of 125% are still current. Many of these people will be stuck in their homes for years - or eventually default.

The third graph shows the break down of negative equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming.

The third graph shows the break down of negative equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming."Nevada had the highest negative equity percentage with 63 percent of all mortgaged properties underwater, followed by Arizona (50 percent), Florida (46 percent), Michigan (36 percent) and California (31 percent). ... Las Vegas led the nation with a 66 percent negative equity share, followed by Stockton (56 percent), Phoenix (55 percent), Modesto (55 percent) and Reno (54 percent)."

• Q1 Flow of Funds: Household Real Estate assets off $6.6 trillion from peak

The Federal Reserve released the Q1 2011 Flow of Funds report this week: Flow of Funds.

This is the Households and Nonprofit net worth as a percent of GDP.

This is the Households and Nonprofit net worth as a percent of GDP.The Fed estimated that the value of household real estate fell $339 billion in Q1 to $16.1 trillion in Q1 2011, from just under $16.5 trillion in Q4 2010. The value of household real estate has fallen $6.6 trillion from the peak - and is still falling in 2011.

Household net worth peaked at $65.8 trillion in Q2 2007. Net worth fell to $49.4 trillion in Q1 2009 (a loss of over $16 trillion), and net worth was at $58.1 trillion in Q1 2011 (up $8.7 trillion from the trough).

Note that this ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles.

This graph shows household real estate assets and mortgage debt as a percent of GDP.

This graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt declined by $85 billion in Q1. Mortgage debt has now declined by $634 billion from the peak. Studies suggest most of the decline in debt has been because of defaults, but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

Assets prices, as a percent of GDP, have fallen significantly and are only slightly above historical levels. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

• BLS: Job Openings decline in April

This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. In general job openings (yellow) has been trending up - however job openings declined slightly in April - and are actually down year-over-year compared to April 2010. However April 2010 included decennial Census hiring, so that isn't a good comparison.

Overall turnover remains low.

• Other Economic Stories ...

• From Fed Chairman Ben Bernanke: The U.S. Economic Outlook• Census Bureau on Homeownership Rate: We've got “Some 'Splainin' to Do”

• Fed's Beige Book: Economic activity continued to expand, "some deceleration"

• Ceridian-UCLA: Diesel Fuel index declines in May

• AAR: Rail Traffic mixed in May

• Lawler: Existing Home Active Listings show Big Declines in Wide Range of Metro Areas

Best wishes to all!

Friday Night: A list of economic data with sources and recent graphs.

• Updated List: Ranking Economic Data