by Calculated Risk on 6/04/2011 10:56:00 AM

Saturday, June 04, 2011

Summary for Week Ending June 3rd

We expected to see a series of weak economic reports last week - falling house prices, weak auto sales, lower ISM manufacturing index, and a weak labor report - and unfortunately that is exactly what happened.

The employment situation report was very disappointing. There were few jobs created (only 54,000 total and 83,000 private sector), and the unemployment rate increased from 9.0% to 9.1%, even though the participation rate was unchanged at 64.2%.

We have to remember that this is just one month – but it was a dismal month. So far the economy has added 908,000 private sector jobs this year, or about 181 thousand per month. The economy has added 783,000 total non-farm jobs this year or 157 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.95 million fewer payroll jobs than at the beginning of the 2007 recession.

The overall employment numbers are very grim: There are a total of 13.9 million Americans unemployed, another 8.5 million working part time for economic reasons, and probably around 4 million more who have just given up looking for a job. And almost half the unemployed - 6.2 million workers - have been unemployed for more than 6 months.

On house prices, Case-Shiller reported that their National Index, and 20 city Composite Index, both hit new post-bubble lows at the end of Q1. David M. Blitzer, Chairman of the Index Committee at S&P Indices said: "Home prices continue on their downward spiral with no relief in sight. Since December 2010, we have found an increasing number of markets posting new lows." However later in the week - and with little press coverage - CoreLogic reported their house price index increased 0.7% in April.

Both auto sales and manufacturing overall were weak in May, although some of this was probably due to supply chain issues in Japan. The good news is the supply issues are being resolved ahead of schedule, so there will probably be a pickup in auto sales in June or July.

But overall this was a very weak week – and May was a very weak month for economic data.

Below is a summary of economic data last week mostly in graphs:

• May Employment Report: 54,000 Jobs, 9.1% Unemployment Rate

The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The unemployment rate increased to 9.1% (red line).

The Labor Force Participation Rate was unchanged at 64.2% in May (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio was unchanged at 58.4% in May (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The current employment recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This was well below expectations for payroll jobs, and the unemployment rate was higher than expected (both worse). Here are the employment posts from yesterday:

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Birth/Death Model and Unemployment by Duration and Education

• Employment graph gallery

• Case Shiller: National Home Prices Hit New Post-Bubble Low

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 31.8% from the peak, and down 0.1% in March (SA). The Composite 10 is still 1.6% above the May 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 31.6% from the peak, and down 0.2% in March (SA). The Composite 20 is only 0.1% above the May 2009 post-bubble bottom seasonally adjusted, and at a new post-bubble low not seasonally adjusted (NSA).

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 7 of the 20 Case-Shiller cities in March seasonally adjusted. Prices in Las Vegas are off 58.3% from the peak, and prices in Dallas only off 7.7% from the peak.

Prices increased (SA) in 7 of the 20 Case-Shiller cities in March seasonally adjusted. Prices in Las Vegas are off 58.3% from the peak, and prices in Dallas only off 7.7% from the peak.From S&P (NSA):

“Home prices continue on their downward spiral with no relief in sight.” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “Since December 2010, we have found an increasing number of markets posting new lows. In March 2011, 12 cities - Atlanta, Charlotte, Chicago, Cleveland, Detroit, Las Vegas, Miami, Minneapolis, New York, Phoenix, Portland (OR) and Tampa - fell to their lowest levels as measured by the current housing cycle.

• ISM Manufacturing index shows slower expansion in May

From the Institute for Supply Management: May 2011 Manufacturing ISM Report On Business®

From the Institute for Supply Management: May 2011 Manufacturing ISM Report On Business® PMI was at 53.5% in May, down sharply from 60.4% in April. The employment index was at 58.2 and new orders at 51.0. (above 50 indicates expansion).

Here is a long term graph of the ISM manufacturing index.

This was well below expectations of 57.5%, but pretty much in line with the regional surveys.

• U.S. Light Vehicle Sales 11.8 million SAAR in May

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.79 million SAAR in May. That is up 1.5% from May 2010, and down 10.2% from the sales rate last month (April 2011).

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.79 million SAAR in May. That is up 1.5% from May 2010, and down 10.2% from the sales rate last month (April 2011).This graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

This was well below the absurd consensus estimate of 12.8 million SAAR. It is difficult to tell how much of the decline is due to supply chain issues - but my guess is we see a bounce back over the next few months.

• ISM Non-Manufacturing Index indicates slightly faster expansion in May

From the Institute for Supply Management: May 2011 Non-Manufacturing ISM Report On Business®

From the Institute for Supply Management: May 2011 Non-Manufacturing ISM Report On Business® The May ISM Non-manufacturing index was at 54.6%, up from 52.8% in April. The employment index increased in May at 54.0%, up from 51.9% in April. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

Both moved up slightly in May, and this was slightly above expectations.

• Construction Spending increased 0.4% in April

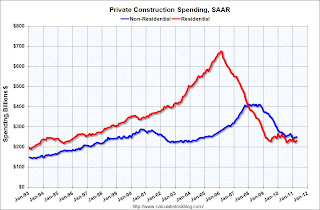

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.The small increase in non-residential in April was mostly due to power. Office and lodging construction spending declined.

Residential spending is 65.7% below the peak in early 2006, and non-residential spending is 39.4% below the peak in January 2008.

I expect residential spending to pick up a little this year (mostly multifamily) - and residential will probably be above non-residential spending by the end of the year.

• Other Economic Stories ...

• The Excess Vacant Housing Supply

• Lawler: Census 2010 and the US Homeownership Rate

• Real House Prices and Price-to-Rent: Back to 1999

• CoreLogic: Home Price Index increased 0.7% between March and April

• Restaurant Performance Index indicates expansion in April

• Chicago PMI shows sharply slower growth, Manufacturing Activity Expands in Texas

• ADP: Private Employment increased by 38,000 in May

Best wishes to all!