by Calculated Risk on 8/23/2011 03:05:00 PM

Tuesday, August 23, 2011

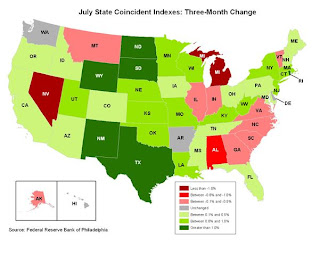

Philly Fed State Coincident Indexes for July

I haven't post this in some time, but the map is turning red again ...

Click on map for larger image.

Above is a map of the three month change in the Philly Fed state coincident indicators. Several states have turned red again. This map was all red during the worst of the recession, and all green not long ago. Here is the Philadelphia Fed state coincident index release (pdf) for July 2011.

In the past month, the indexes increased in 29 states, decreased in 13, and remained unchanged in eight for a one-month diffusion index of 32. Over the past three months, the indexes increased in 34 states, decreased in 12, and remained unchanged in four (Arkansas, Delaware, Hawaii, and Washington) for a three-month diffusion index of 44.

The second graph is of the monthly Philly Fed data for the number of states with one month increasing activity.

The second graph is of the monthly Philly Fed data for the number of states with one month increasing activity. The indexes increased in 29 states, decreased in 13, and remained unchanged in 8. Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.On July Home Sales:

• New Home Sales in July at 298,000 Annual Rate

• Last week: Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales