by Calculated Risk on 9/13/2011 07:54:00 AM

Tuesday, September 13, 2011

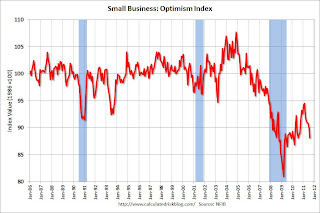

NFIB: Small Business Optimism Index declines in August

From the National Federation of Independent Business (NFIB): Small Business Confidence Takes Huge Hit: Optimism Index Now in Decline for Six Months Running

Confidence in the economy among small-business owners tumbled in August, as NFIB’s monthly Small-Business Optimism Index dropped a whopping 1.8 points, settling at a disturbingly low 88.1. The Index has now been in decline for a full six months. Unlike previous months, August’s decline comes in the immediate aftermath of the debt ceiling debate ...Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

Sales remain the largest problem for small firms—a full quarter identifying “poor sales” as their top business problem.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The first graph shows the small business optimism index since 1986. The index decreased to 88.1 in August from 89.9 in July.

Optimism has declined for six consecutive months now.

The second graph shows the net hiring plans for the next three months.

Hiring plans were still low in August, but positive and improving.

Hiring plans were still low in August, but positive and improving. According to NFIB: “While the readings remain historically weak, we can find a grain of encouragement as we look at hiring prospects. Over the next three months, 11 percent plan to increase employment (up 1 point), and 12 percent plan to reduce their workforce (also up 1 point), yielding a seasonally adjusted net 5 percent of owners planning to create new jobs, which is a 3 point improvement over July."

Weak sales is still the top business problem with 25 percent of the owners reporting that weak sales continued to be their top business problem in August.

In good times, owners usually report taxes and regulation as their biggest problems.

In good times, owners usually report taxes and regulation as their biggest problems.The optimism index declined sharply in August due to the debt ceiling debate. This index has been generally slow to recover and has declined for six consecutive months - probably due to a combination of the recent economic weakness, and also the high concentration of real estate related companies in the index.