by Calculated Risk on 11/30/2011 09:45:00 PM

Wednesday, November 30, 2011

China's stop-and-go measures

The post title is from a post Michael Pettis wrote last year: Beijing’s stop-and-go measures. It looks like China is back to pushing on the gas pedal ...

From the NY Times: China, in Surprising Shift, Takes Steps to Spur Bank Lending

China’s central bank, in a surprise move on Wednesday, shifted its economic focus from fighting inflation to stimulating growth by freeing the nation’s commercial banks to lend more money.From Reuters: China Factory Sector Shrinks First Time in Nearly 3 Years

...

For more than a year, the Chinese central bank tried to squeeze the country’s banking system in hopes of restraining inflation. Its action on Wednesday’s indicated that China’s government feared the country’s growth engine was starting to falter.

China's factory sector shrank in November for the first time in nearly three years, an official purchasing managers' index (PMI) showed on Thursday, underlining the central bank's move to cut bank reserve requirements to shore up the economy.The Asian markets are all green tonight. The Nikkei is up about 2%, the Hang Seng is up 5.4%.

Fannie Mae and Freddie Mac Serious Delinquency Rates mostly unchanged in October

by Calculated Risk on 11/30/2011 05:27:00 PM

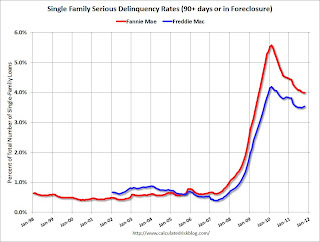

Fannie Mae reported that the Single-Family Serious Delinquency rate was unchanged at 4.00% in October. This is down from 4.52% in October of 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate increased to 3.54% in October, up from 3.51% in September. This is down from 3.82% in October 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Tracking this on a monthly basis this is kind of like watching grass grow, but the serious delinquency rates are generally falling - but only falling slowly. The reason for the slow decline is most likely the backlog of homes in the foreclosure process.

The "normal" serious delinquency rate is under 1%, and at this pace of decline, the delinquency rate will not be back to "normal" for a number of years.

Fed's Beige Book: "Economic activity increased at a slow to moderate pace"

by Calculated Risk on 11/30/2011 02:00:00 PM

Overall economic activity increased at a slow to moderate pace since the previous report across all Federal Reserve Districts except St. Louis, which reported a decline in economic activity.And on real estate:

...

District reports indicated that consumer spending increased modestly, on balance, during the reporting period.

...

Hiring was generally subdued, but some firms with open positions reported difficulty finding qualified applicants.

Overall residential real estate activity increased, but conditions were varied across Districts. Philadelphia, Richmond, Minneapolis, Kansas City, and Dallas noted increased activity. New York, Boston, Cleveland, and San Francisco reported flat activity at relatively low levels. Atlanta and St. Louis indicated decreased sales. Residential construction remained sluggish. Single-family home construction remained weak, while multifamily construction picked up in New York, Philadelphia, Cleveland, Chicago, and Minneapolis. San Francisco remained "anemic," while St. Louis and Kansas City reported decreased activity.This was based on data gathered on or before November 18th. More sluggish growth ...

Commercial real estate markets remained sluggish across most of the nation. Boston, New York, Chicago, Minneapolis, and San Francisco indicated roughly unchanged activity. Atlanta and Kansas City noted slight improvement. Philadelphia and Dallas indicated mixed activity. However, Richmond and St. Louis noted that vacancy rates increased. Commercial construction was somewhat mixed.

Restaurant Performance Index "essentially unchanged" in October

by Calculated Risk on 11/30/2011 11:31:00 AM

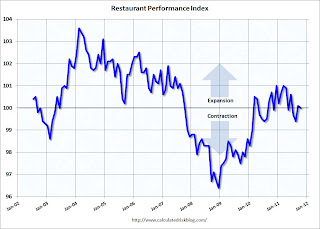

From the National Restaurant Association: Restaurant Performance Index Essentially Unchanged in October, Balanced by Softer Current Conditions and Stronger Future Optimism

The National Restaurant Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.0 in October, essentially unchanged from September’s level of 100.1. October’s steady RPI level was the result of softer sales and customer traffic being offset by a more optimistic outlook among restaurant operators.

“Although sales results were somewhat softer in October, restaurant operators reported net positive same-store sales for the fifth consecutive month,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, each of the four forward-looking indicators improved in October, which pushed the Expectations Index to its highest level in four months.”

...

Restaurant operators reported positive same-store sales for the fifth consecutive month in October, although results were somewhat softer than September’s performance. ... Restaurant operators also reported softer customer traffic levels in October.

Click on graph for larger image.

Click on graph for larger image.The index decreased to 100.0 in October (above 100 indicates expansion).

Unfortunately the data for this index only goes back to 2002.

Restaurant spending is discretionary and is impacted by the overall economy. Right now this is moving sideways ...

Misc: Chicago PMI increases to 62.6, Pending Home Sales increase

by Calculated Risk on 11/30/2011 10:00:00 AM

• Chicago PMI: The overall index increased to 62.6 in November from 58.4 in October. This was above consensus expectations of 58.5.

From the Chicago ISM Chicago Business Barometer™ Rebounded:

The Chicago Purchasing Managers reported the CHICAGO BUSINESS BAROMETER rebounded to a 7-month high in November and marked the 26th month of expansion.The employment index decreased to 56.9 from 62.3. "EMPLOYMENT reversed half of its gains since August"

The new orders index increased to 70.2 from 61.3. "NEW ORDERS expanded to an 8-month high and PRODUCTION expanded to a 7-month high"

Note: any number above 50 shows expansion.

• From the NAR: Pending Home Sales Jump in October

The Pending Home Sales Index, a forward-looking indicator based on contract signings, surged 10.4 percent to 93.3 in October from 84.5 in September and is 9.2 percent above October 2010 when it stood at 85.5. The data reflects contracts but not closings.

...

The PHSI in the Northeast surged 17.7 percent to 71.3 in October and is 3.4 percent above October 2010. In the Midwest the index jumped 24.1 percent to 88.7 in October and remains 13.2 percent above a year ago. Pending home sales in the South rose 8.6 percent in October to an index of 99.5 and are 9.7 percent higher than October 2010. In the West the index slipped 0.3 percent to 105.5 in October but is 8.1 percent above a year ago.

ADP: Private Employment increased 206,000 in November

by Calculated Risk on 11/30/2011 08:19:00 AM

On Central Bank action, from the WSJ: Central Banks Take Coordinated Action and from the Federal Reserve: "The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank are today announcing coordinated actions to enhance their capacity to provide liquidity support to the global financial system. The purpose of these actions is to ease strains in financial markets and thereby mitigate the effects of such strains on the supply of credit to households and businesses and so help foster economic activity."

Original post:

ADP reports:

ADP today reported that employment in the U.S. nonfarm private business sector increased by 206,000 from October to November on a seasonally adjusted basis. The estimated advance in employment from September to October was revised up to 130,000 from the initially reported 110,000. The increase in November was the largest monthly gain since last December and nearly twice the average monthly gain since May when employment decelerated sharply.This was well above the consensus forecast of an increase of 130,000 private sector jobs in November. The BLS reports on Friday, and the consensus is for an increase of 112,000 payroll jobs in November, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector rose 178,000 in November, which is up from an increase of 130,000 in October. Employment in the private, goods-producing sector increased 28,000 in November, while manufacturing employment increased 7,000.

Government payrolls have been shrinking by about 27,000 per month this year. So this suggests around 206,000 private nonfarm payroll jobs added, minus 27,000 government workers - or around 179,000 total jobs added in November. Of course ADP hasn't been very useful in predicting the BLS report.

Report: Payroll Tax Cut extension is likely

by Calculated Risk on 11/30/2011 12:45:00 AM

From the WSJ: GOP Set to Back Payroll-Tax Cut

Republican leaders said Tuesday they would join Democrats in supporting an extension of the 2011 payroll-tax cut ... virtually assuring that American wage-earners will continue to receive the benefit next year.Probably the two most significant downside risks to the U.S. economy are contagion from the European financial crisis and more rapid fiscal tightening. The extension of the payroll tax cut will lessen the amount of fiscal tightening in 2012 - although government spending will still be a drag on GDP growth next year.

...

Workers this year have seen their payroll taxes cut to 4.2% of their salary from 6.2%. Democrats want to cut it further, to 3.1%, but Republicans are unlikely to support that.

Earlier:

• CoreLogic: 10.7 Million U.S. Properties with Negative Equity in Q3

• Case Shiller: Home Prices decline in September

• Real House Prices and House Price-to-Rent

Tuesday, November 29, 2011

Preparing for the end of the Euro

by Calculated Risk on 11/29/2011 08:10:00 PM

The top story in the Financial Times says it all: Businesses plan for possible end of euro

Here is a quote from someone at Volkswagen: “The conclusion is that overall the impact would not be so negative to our company, as we are mainly an exporter ..."

Export to whom?

Earlier:

• CoreLogic: 10.7 Million U.S. Properties with Negative Equity in Q3

• Case Shiller: Home Prices decline in September

• Real House Prices and House Price-to-Rent

Europe: EFSF viewed as insufficient, Greece to receive aid payment

by Calculated Risk on 11/29/2011 04:46:00 PM

• From the Athens News: Eurogroup signs off on 8bn euro aid payment

Eurozone finance ministers agreed on Tuesday to release an 8bn euro aid payment to Greece, part of an 110bn euro package of support agreed with the government last year ...It looks like Greece will not default in December, but there is a huge hurdle in January when the private creditors are supposed to "voluntarily" agree to large haircuts.

• Surprise! The EFSF is insufficient.

From the WSJ: Euro Zone Sees Shortfall in Rescue Fund

Euro-zone finance ministers acknowledged on Tuesday that the bloc's bailout fund would have less capacity to help troubled nations than once hoped, and stepped up calls on the European Central Bank and the International Monetary Fund to come to their aid.From the Financial Times: Fears of shortfall lead to moves to boost EFSF

An analysis presented at a meeting of finance ministers here suggested the fund would be able to raise a maximum of €500 billion to €700 billion ($666 billion to $932 billion), far short of the €1 trillion or even €2 trillion that many had expected. ... ministers are exploring further measures to stem the crisis, which they hope to announce at a European summit on Dec. 8-9.

Eurozone finance ministers are weighing more radical options to strengthen their firewall against the sovereign debt crisis, after acknowledging that plans to expand the €440bn eurozone rescue fund could deliver as little as half the extra punch that was anticipated.• European bond yields were mostly lower today after (from Bloomberg) Italy Pays More Than 7% at Auction of EU7.5 Billion of Bonds

Excerpt with permission

Italy was again forced to pay above the 7 percent threshold that led Greece, Portugal and Ireland to seek bailouts when it sold 7.5 billion euros ($10.1 billion) in bonds today, short of the maximum target for the auction.The Italian 2 year yield was down to 7.1%, and the 10 year yield was at 7.24%.

The Spanish 2 year yield was down to 5.6%, and the 10 year yield was down to 6.39%.

The Belgian 10 year yield was down to 5.33%, and the French 10 year yield was down to 3.52%.

Note: There is a link below the first post for the table of European bond yields.

• Tim Duy has more: Another European "Solution" Coming?

Earlier:

• CoreLogic: 10.7 Million U.S. Properties with Negative Equity in Q3

• Case Shiller: Home Prices decline in September

• Real House Prices and House Price-to-Rent

Philly Fed State Coincident Indexes increase in October

by Calculated Risk on 11/29/2011 03:14:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for October 2011. In the past month, the indexes increased in 43 states, decreased in five, and remained unchanged in two (Georgia and New Mexico) for a one-month diffusion index of 76. Over the past three months, the indexes increased in 42 states, decreased in seven, and remained unchanged in one (Delaware) for a three-month diffusion index of 70.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In October, 45 states had increasing activity, up from 39 in September. This is the highest level since April.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green earlier this year - but this is an improvement from September.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green earlier this year - but this is an improvement from September.Earlier:

• CoreLogic: 10.7 Million U.S. Properties with Negative Equity in Q3

• Case Shiller: Home Prices decline in September

• Real House Prices and House Price-to-Rent

Real House Prices and House Price-to-Rent

by Calculated Risk on 11/29/2011 12:46:00 PM

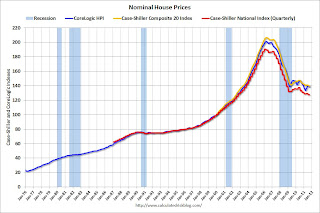

An update: Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 2000 levels.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2011), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through September) in nominal terms (as reported).

In nominal terms, the Case-Shiller National index (SA) is back to Q4 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to April 2003 levels, and the CoreLogic index is back to June 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q1 1999 levels, the Composite 20 index is back to May 2000, and the CoreLogic index back to April 2000.

In real terms, all appreciation in the '00s is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is back to June 2000 levels, and the CoreLogic index is back to May 2000.

In real terms - and as a price-to-rent ratio - prices are mostly back to 2000 levels and will probably be back to 1999 levels in the next few months.

Earlier:

• CoreLogic: 10.7 Million U.S. Properties with Negative Equity in Q3

• Case Shiller: Home Prices decline in September

CoreLogic: 10.7 Million U.S. Properties with Negative Equity in Q3

by Calculated Risk on 11/29/2011 10:55:00 AM

CoreLogic released the Q3 2011 negative equity report today.

CoreLogic ... today released negative equity data showing that 10.7 million, or 22.1 percent, of all residential properties with a mortgage were in negative equity at the end of the third quarter of 2011. This is down slightly from 10.9 million properties, or 22.5 percent, in the second quarter. An additional 2.4 million borrowers had less than 5 percent equity, referred to as near-negative equity, in the third quarter.Here are a couple of graphs from the report:

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada has the highest negative equity percentage with 58 percent of all of its mortgaged properties underwater, followed by Arizona (47 percent), Florida (44 percent), Michigan (35 percent) and Georgia (30 percent). This is the first quarter that Georgia entered the top five, surpassing California which had been in the top five since tracking began in 2009.

The top five states combined have an average negative equity ratio of 41.4 percent, while the remaining states have a combined average negative equity ratio of 17.6 percent."

The second graph shows the distribution of equity by state- black is Loan-to-value (LTV) of less than 80%, blue is 80% to 100%, red is a LTV of greater than 100% (or negative equity). Note: This only includes homeowners with a mortgage - about 31% of homeowners nationwide do not have a mortgage.

The second graph shows the distribution of equity by state- black is Loan-to-value (LTV) of less than 80%, blue is 80% to 100%, red is a LTV of greater than 100% (or negative equity). Note: This only includes homeowners with a mortgage - about 31% of homeowners nationwide do not have a mortgage.Some states - like New York - have a large percentage of borrowers with more than 20% equity, and Nevada, Arizona and Florida have the fewest borrowers with more than 20% equity.

Some interesting data on borrowers with and without home equity loans from CoreLogic: "Of the 10.7 million borrowers in negative equity, there are 6.3 million first liens without home equity loans that have an average mortgage balance of $222,000. They are underwater by an average of $52,000 which equates to an average LTV ratio of 131 percent. The negative equity share for the first lien-only borrowers was 18 percent, and 40 percent had an LTV of 80 percent or higher.

The remaining 4.4 million negative equity borrowers hold first liens and home equity loans with an average mortgage balance of $309,000. These borrowers are underwater by an average of $84,000 and have an average LTV of 137 percent."

Case Shiller: Home Prices decline in September

by Calculated Risk on 11/29/2011 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for September (a 3 month average of July, August and September). This release includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities) and the national quarterly index for Q3.

Note: Case-Shiller reports NSA, I use the SA data. Here is a table of the year-over-year and monthly changes for both SA and NSA.

| Case Shiller September 2011 | Seasonally Adjusted | Not Seasonally Adjusted | ||

|---|---|---|---|---|

| YoY Change | One Month Change | YoY Change | One Month Change | |

| Composite 10 | -3.3% | -0.4% | -3.3% | -0.4% |

| Composite 20 | -3.6% | -0.6% | -3.6% | -0.6% |

From S&P: Home Prices Weaken as the Third Quarter of 2011 Ends

The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 3.9% decline in the third quarter of 2011 over the third quarter of 2010. In September, the 10- and 20-City Composites posted annual rates of decline of 3.3% and 3.6%, respectively. Eighteen of the 20 MSAs and both monthly Composites had negative annual rates in September 2011, the only exceptions being Detroit and Washington DC.

“Home prices drifted lower in September and the third quarter,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “The National Index was down 3.9% versus the third quarter of 2010 and up only 0.1% from the previous quarter. Three cities posted new index lows in September 2011 - Atlanta, Las Vegas and Phoenix. Seventeen of the 20 cities and both Composites were down for the

month.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.5% from the peak, and down 0.4% in September (SA). The Composite 10 is 0.5% above the June 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 32.5% from the peak, and down 0.6% in September (SA). The Composite 20 is at a new post-bubble low.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.3% compared to September 2010.

The Composite 20 SA is down 3.6% compared to September 2010. This is slightly smaller year-over-year decline than in August.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 5 of the 20 Case-Shiller cities in September seasonally adjusted. Prices in Las Vegas are off 60.6% from the peak, and prices in Dallas only off 8.6% from the peak.

Prices increased (SA) in 5 of the 20 Case-Shiller cities in September seasonally adjusted. Prices in Las Vegas are off 60.6% from the peak, and prices in Dallas only off 8.6% from the peak.Prices are now falling again, and the Case-Shiller Composite 20 (SA) hit a new post-bubble low.

Monday, November 28, 2011

NY Times: "Crisis in Europe Tightens Credit Across the Globe"

by Calculated Risk on 11/28/2011 11:04:00 PM

From the NY Times: Crisis in Europe Tightens Credit Across the Globe

Europe’s worsening sovereign debt crisis has spread beyond its banks and the spillover now threatens businesses on the Continent and around the world.I've been watching some of the credit indicators we tracked several years ago - like the TED spread and the two year U.S. dollar swap spread - both are rising, but are well below the levels during the financial crisis. Probably the most significant channel of contagion from the European financial crisis would be tightening of U.S. credit conditions - and so far the tightening in the U.S. appears to be minimal. However, as the NY Times story points out, tighter credit could be impacting U.S. trading partners "from Berlin to Beijing".

From global airlines and shipping giants to small manufacturers, all kinds of companies are feeling the strain as European banks pull back on lending in an effort to hoard capital and shore up their balance sheets.

The result is a credit squeeze for companies from Berlin to Beijing ...

Earlier on New Homes:

• New Home Sales in October: 307,000 SAAR

• New Home Prices: Average Lowest since 2003

• All current New Home Graphs

Visible Existing Home Inventory declines 17% year-over-year in November

by Calculated Risk on 11/28/2011 07:50:00 PM

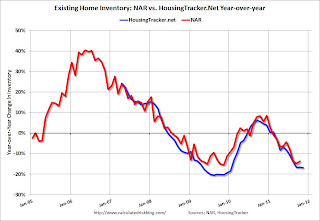

Another update: I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this back in June (Tom also discussed how the NAR estimates existing home inventory - they don't aggregate data from local boards!)

In a few months, the NAR is expect to release revisions for their existing home sales and inventory numbers for the last few years. The sales and inventory revisions will be down (the NAR has pre-announced this).

Using the deptofnumbers.com for monthly inventory (54 metro areas), it appears inventory will be back to 2005 levels this month. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the NAR estimate of existing home inventory through October (left axis) and the HousingTracker data for the 54 metro areas through November. The HousingTracker data shows a steeper decline in inventory over the last few years (as mentioned above, the NAR will probably revise down their inventory estimates in a few months).

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the November listings - for the 54 metro areas - declined 16.9% from the same month last year.

This is just "visible inventory" (inventory listed for sales). There is a large percentage of distressed inventory, and various categories of "shadow inventory" too, but visible inventory has clearly declined in many areas.

Earlier on New Homes:

• New Home Sales in October: 307,000 SAAR

• New Home Prices: Average Lowest since 2003

• All current New Home Graphs

Dallas Fed Manufacturing Survey shows contraction in November

by Calculated Risk on 11/28/2011 04:09:00 PM

This is the last of the regional Fed surveys for November. The regional surveys provide a hint about the ISM manufacturing index - and the regional surveys were mixed and still fairly weak in November.

From the Dallas Fed: Texas Manufacturing Activity Declines

Texas factory activity decreased in November, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, dipped from 4.1 to –5.1, registering its first negative reading in two years.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Other measures of current manufacturing conditions also indicated contraction in November. The new orders index suggested deterioration of demand, falling to –5.1 after a year in positive territory. ... The capacity utilization index tumbled to –10.2 after several months of weak readings centered around zero.

Perceptions of broader economic conditions improved slightly in November. The general business activity index posted its second positive reading in a row, and it edged up from 2.3 to 3.2. The company outlook index remained positive but moved down from 7.2 to 4.7. More than 90 percent of manufacturers said their outlooks were unchanged or improved from last month.

Labor market indicators reflected continued labor demand growth, albeit at a slower pace. The employment index came in at 9, down from 15.1 in October.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through November), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

The ISM index for November will be released Thursday, Dec 1st and the regional surveys suggest another fairly weak reading in November. The consensus is for a slight increase to 51.7 from 50.8 in Octobeber.

New Home Prices: Average Lowest since 2003

by Calculated Risk on 11/28/2011 01:37:00 PM

As part of the new home sales report, the Census Bureau reported that the average price for new homes fell to the lowest level since September 2003.

From the Census Bureau: "The median sales price of new houses sold in October 2011 was $212,300; the average sales price was $242,300."

The following graph shows the median and average new home prices. The average new home price is at the lowest level since August 2003.

Click on graph for larger image.

Click on graph for larger image.

This makes sense - to compete with all the distressed sales, the builders have had to build smaller and less expensive homes.

The second graph shows the percent of new home sales by price. At the peak of the housing bubble, almost 40% of new homes were sold for more than $300K - and over 20% were sold for over $400K. In October, only 20% were sold for more than $300K - and only 8% for over $400K.

Almost half of all home sales in October were under $200K - and about 80% of home sales were under $300K. This is the lowest percentage under $300K since November 2002.

Almost half of all home sales in October were under $200K - and about 80% of home sales were under $300K. This is the lowest percentage under $300K since November 2002.

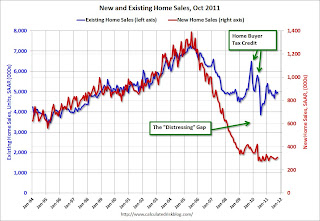

The third graph shows existing home sales (left axis) and new home sales (right axis) through October.

This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared due mostly to distressed sales.

The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

I expect this gap to close over the next few years once the number of distressed sales starts to decline.

Note: The National Association of Realtors (NAR) is working on a benchmark revision for existing home sales numbers and I expect significant downward revisions to sales estimates for the last few years - perhaps as much as 10% to 15% for 2011. Even with these revisions, most of the "distressing gap" will remain.

Earlier:

• New Home Sales in October: 307,000 SAAR

• All current New Home Graphs

NY Fed Q3 Report on Household Debt and Credit

by Calculated Risk on 11/28/2011 11:56:00 AM

From the NY Fed: Consumer Debt Falls in Third Quarter

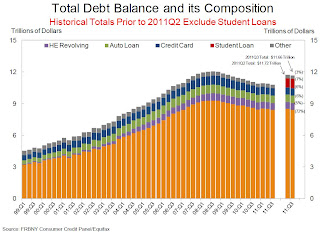

Aggregate consumer debt fell approximately $60 billion to $11.66 trillion in the third quarter of 2011 according to the Federal Reserve Bank of New York’s latest Quarterly Report on Household Debt and Credit.Here is the Q3 report: Quarterly Report on Household Debt and Credit. Here are two graphs:

...

"The decline in outstanding consumer debt reveals that households continue to try and deleverage in the wake of a challenging economic environment and large declines in home values," said Andrew Haughwout, vice president in the Research and Statistics Group at the New York Fed. "However, our findings also provide evidence that consumer credit demand continues to increase, a positive sign for consumer sentiment."

Click on graph for larger image.

Click on graph for larger image.The first graph shows aggregate consumer debt decreased slightly in Q3. From the NY Fed:

Aggregate consumer debt fell slightly in the third quarter. As of September 30, 2011, total consumer indebtedness was $11.66 trillion, a reduction of $60 billion (0.6%) below its (revised) June 30, 2011 level. The 2011Q2 and 2011Q3 totals reflect improvements in our measurement of student loan balances, which we had previously undercounted ... As a result, student loan and total debt balances for 2011Q2 and 2011Q3 are not directly comparable to earlier data ...

Mortgage balances shown on consumer credit reports fell noticeably ($114 billion or 1.3%) during the quarter; home equity lines of credit (HELOC) balances rose by $14 billion (2.3%). Household mortgage and HELOC indebtedness are now 9.6% and 10.5%, respectively, below their peaks. Consumer indebtedness excluding mortgage and HELOC balances rose slightly ($32 billion or about 1.3%) in the quarter. Consumers’ non-real estate indebtedness now stands at $2.62 trillion.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining (there was a small increase in Q3), but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining (there was a small increase in Q3), but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). From the NY Fed:

Total household delinquency rates rose in 2011Q3. As of September 30, 10.0% of outstanding debt was in some stage of delinquency, compared to 9.8% on June 30. About $1.2 trillion of consumer debt is currently delinquent, with $834 billion seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

About 264,000 individuals had a foreclosure notation added to their credit reports between June 30 and September 30, a 7% decrease from the 2011Q2 level of new foreclosures. New bankruptcies in 2011Q3 were 18.8% below their levels of 2010Q3, at 423,000.

Earlier:

• New Home Sales in October: 307,000 SAAR

New Home Sales in October: 307,000 SAAR

by Calculated Risk on 11/28/2011 10:00:00 AM

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 307 thousand. This was up from a revised 303 thousand in September (revised down from 313 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in October 2011 were at a seasonally adjusted annual rate of 307,000 ... This is 1.3 percent (±19.7%)* above the revised September rate of 303,000 and is 8.9 percent (±17.2%)* above the October 2010 estimate of 282,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

Months of supply decreased to 6.3 in October.

The all time record was 12.1 months of supply in January 2009.

This is still slightly higher than normal (less than 6 months supply is normal).

This is still slightly higher than normal (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of October was 162,000. This represents a supply of 6.3 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at 60,000 units in October. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In October 2011 (red column), 25 thousand new homes were sold (NSA). This was just above the record low for October of 23 thousand set in 2010. The high for October was 105 thousand in 2005.

This was slightly below the consensus forecast of 310 thousand, and just above the record low for the month of October set last year (NSA).

This was slightly below the consensus forecast of 310 thousand, and just above the record low for the month of October set last year (NSA). New home sales have averaged only 299 thousand SAAR over the 18 months since the expiration of the tax credit ... mostly moving sideways at a very low level.

OECD: Euro zone in recession

by Calculated Risk on 11/28/2011 08:47:00 AM

The OECD's track record hasn't been great lately, but it does seem likely that the euro zone is already in a recession ...

From Reuters: Euro Zone in Mild Recession, US May Follow: OECD

The global economic recovery is running out of steam, leaving the euro zone stuck in a mild recession ... In the absence of decisive action from euro zone leaders, the European Central Bank (ECB) alone has the power to contain the bloc's crisis, the Paris-based [Organization for Economic Cooperation and Development] said.And here is the report from the OECD: OECD calls for urgent action to boost ailing global economy

...

Its twice-yearly Economic Outlook forecast world growth would slow to 3.4 percent in 2012 from 3.8 percent this year.

Yesterday:

• Summary for Week Ending Nov 25th

• Schedule for Week of Nov 27th

Sunday Night Futures

by Calculated Risk on 11/28/2011 12:07:00 AM

From MarketWatch: Europe agrees on EFSF; IMF may aid Italy: reports

Finance ministers from the euro zone are slated to meet Tuesday and expected to sign off on rules for borrowing against the European Financial Stability Facility (EFSF), as well as guidelines for intervening in the euro-zone bond markets and providing credit lines to governments, according to a Reuters report Sunday.And the denial from Dow Jones:

...

The reports on the EFSF deal came amid reports that the IMF may offer €400 billion to €600 billion in aid to Italy, Dow Jones Newswires reported Sunday, citing an unsourced account in Italy’s La Stampa.

A report that the International Monetary Fund could offer Italy between EUR400 billion and EUR600 billion in financial support is not credible, people familiar with ongoing international discussions on the European debt crisis said Monday.The Asian markets are mostly green tonight. The Nikkei is up about 1.8%, the Hang Seng is up 1.9%.

The report is "not credible," one of the people told Dow Jones Newswires

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are up about 20 and Dow futures are up 160.

Oil: WTI futures are up to $98.29 and Brent is up to $107.64 per barrel.

Yesterday:

• Summary for Week Ending Nov 25th

• Schedule for Week of Nov 27th

Sunday, November 27, 2011

Wolfgang Münchau: "Only days to avoid collapse" of eurozone, Currency Market prepares for breakup

by Calculated Risk on 11/27/2011 08:12:00 PM

From Wolfgang Münchau at the Financial Times: The eurozone really has only days to avoid collapse

First, the European Central Bank must agree a backstop of some kind ... The second measure is a firm timetable for a eurozone bond. ... The third decision is a fiscal union. ...See Brad DeLong's post for more excerpts.

If the European summit could reach a deal on December 9, its next scheduled meeting, the eurozone will survive. If not, it risks a violent collapse.

From the WSJ: Europe's Leaders Pursue New Pact

The proposal ... would make budget discipline legally binding and enforceable by European authorities. ... A majority of euro-zone governments hope that the pact would be an unstated quid pro quo for massive intervention in bond markets by the ECB. Many policy makers, investors and economists believe that only decisive ECB action can stop the unraveling of euro-zone debt markets ...From the WSJ: Inner Workings of Market Readied for Euro Breakup

Companies that provide the plumbing for the $4 trillion-a-day foreign-exchange market are testing systems that could handle trading of previously shelved European currencies. ... Banks, analysts and investors are preparing for what many of them say is an increasing likelihood of a euro-zone breakup, either completely or in parts, leading to the potential return of currencies such as the drachma, German mark or Italian lira.Interesting times.

Earlier:

• Summary for Week Ending Nov 25th

• Schedule for Week of Nov 27th

Report: Payroll tax cut extension is likely

by Calculated Risk on 11/27/2011 05:57:00 PM

The two key downside risks to the U.S. economy are contagion from the European financial crisis and more rapid fiscal tightening. On fiscal tightening, there have been several recent reports suggesting that some sort of deal will be reached an the extension of the payroll tax cut.

From the LA Times: Parties look to payroll tax deal after collapse of deficit talks

The Obama administration has asked Congress to extend payroll tax cuts set to expire at the end of the year, and also to renew unemployment benefits. The tax-cut extension could cost the Treasury an estimated $112 billion, but if it lapses American workers will see an immediate tax increase on Jan. 1 that would cost a typical family $1,000 per year.It seems likely that some sort of deal will be reached to extend both the payroll tax cut and emergency unemployment benefits, but there will be some politics first.

...

Economists warn that a failure to extend the payroll tax cut and unemployment benefits could cut the economy’s weak growth almost in half next year.

Earlier:

• Summary for Week Ending Nov 25th

• Schedule for Week of Nov 27th

Tim Duy: "Europe Scrambles for Solutions"

by Calculated Risk on 11/27/2011 02:14:00 PM

From Tim Duy at Fed Watch: Europe Scrambles for Solutions. Some excerpts:

Monday morning is fast approaching, and European leaders are scrambling to come up with something credible to float ahead of the market opening. Recall that we ended last week with the S&P downgrade of Belgium, and policymakers would like to have something on the table in response. Most significant is that policymakers now realize that changing the Lisbon Treaty to enshrine fiscal discipline is a far too lengthy process to serve as an effective counterweight to emerging the sovereign debt crisis.

...

The risk here is that market participants read the bilateral agreements as they emerge as an invitation to attack those nations not yet signed up to the plan.

...

Note also that although these ideas are bandied about in terms of "greater fiscal integration," I don't think we are seeing much mention of fiscal transfers, just mechanisms to enforce budget discipline. This is certainly a framework for a two-speed Europe.

In other news, someone is floating rumors that the IMF is preparing a massive lending program for Italy. From Bloomberg:The International Monetary Fund is preparing a 600-billion euro ($794 billion) loan for Italy in case the country’s debt crisis worsens, La Stampa said.Details are unclear. Ed Harrison at Credit Writedowns has a translation of a German version of the story that mentions the possibility of ECB funding of the bailout, with an IMF guarantee.

The money would give Italy’s Prime Minister Mario Monti 12 to 18 months to implement his reforms without having to refinance the country’s existing debt, the Italian daily reported, without saying where it got the information. Monti could draw on the money if his planned austerity measures fail to stop speculation on Italian debt, La Stampa said.

Report: Black Friday sales up 7%

by Calculated Risk on 11/27/2011 09:52:00 AM

With all the "Black Friday" reports, it is important to remember that retail sales are only a small portion of consumer spending.

According to the Bureau of Economic Analysis (BEA), of the $10.8 trillion in personal consumption expenditures in Q3 (seasonally adjusted annual rate), about 34% was spent on goods. From Suzi Khimm at the Wonkblog: Why a Black Friday frenzy doesn’t mean jobs are coming back

Consumer spending on goods is starting to rebound, but spending on services — a key driver of job growth — is lagging significantly farther behind.And from MarketWatch: Black Friday posts big retail-sales gains vs. 2010

U.S. retailers posted sizable "Black Friday" gains vs. 2010's day-after-Thanksgiving sales results, according to data released Saturday. Store sales, according to Chicago-based ShopperTrak, rose 7%, as shoppers spent $11.4 billion, up nearly $1 billion from a year ago ...Earlier:

• Summary for Week Ending Nov 25th

• Schedule for Week of Nov 27th

Saturday, November 26, 2011

Report:: Euro-zone considering bilateral agreements for fiscal integration

by Calculated Risk on 11/26/2011 06:37:00 PM

As we all know the markets are moving faster than the policymakers in Europe. So it appears the policymakers are going to try to implement a fiscal union quicker.

But will that help? Will it bring private investors back into the bond market? Probably not, but some people think it might allow the ECB to take more aggressive action.

Oh well, the new key date is Friday December 9th.

From the WSJ: Euro Zone Weighs Plan to Speed Fiscal Integration

Euro-zone countries are weighing a new plan to accelerate the integration of their fiscal policies ... Under the proposed plan, national governments would seal bilateral agreements that wouldn't take as long as a cumbersome change to European Union treaties ... The pact that euro members are considering could be announced before the EU summit on Dec. 9 ... Some German and French officials fear that an EU treaty change could take far too long.Earlier:

...

A new, binding fiscal regime would not be enough to justify the creation of collective euro-zone bonds, German officials say. But it might be enough to justify ECB action to stabilize bond markets

• Summary for Week Ending Nov 25th

• Schedule for Week of Nov 27th

Schedule for Week of Nov 27th

by Calculated Risk on 11/26/2011 01:31:00 PM

Earlier:

• Summary for Week Ending Nov 25th

The key report this week will be the employment situation report for November on Friday. Other key reports include the November ISM manufacturing index on Thursday, auto sales also on Thursday, and two important housing reports to be released early in the week: New Home sales on Monday and Case-Shiller house prices on Tuesday.

10:00 AM ET: New Home Sales for October from the Census Bureau.

10:00 AM ET: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

The consensus is for a slight decrease in sales to 310 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 313 thousand in September.

10:00 AM: NY Fed Q3 Report on Household Debt and Credit

10:30 AM: Dallas Fed Manufacturing Survey for November. The index showed some expansion in October with a reading of 4.1. This is the last of the regional Fed manufacturing surveys for November, and the results have been mixed - but generally better than in October.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The consensus is for a 3.0% year-over-year decrease in prices in September, or mostly flat to slightly down from August. The CoreLogic index showed a 1.1% decrease in September (NSA).

10:00 AM: Conference Board's consumer confidence index for November. The consensus is for an increase to 44.2 from 39.8 last month.

10:00 AM: FHFA House Price Index for September 2011. This is based on GSE repeat sales and is not as closely followed as Case-Shiller (or CoreLogic). However the quarterly FHFA expanded series house price index makes use of "additional sales price information from external data sources" and might be followed more closely in the future.

11:30 AM: Federal Reserve Vice Chair Janet Yellen speaks at the Federal Reserve Bank of San Francisco, San Francisco, Calif. "The Global Economic Recovery".

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak since early August, although this doesn't include cash buyers.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 130,000 payroll jobs added in November, up from the 110,000 reported in October.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for a slight increase to 58.5 from 58.4 in October.

10:00 AM: Pending Home Sales Index for October. The consensus is for a 1.2% increase in the index.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a slight decrease to 390,000 from 393,000 last week. The 4-week average has recently declined to below 400,000.

10:00 AM: Construction Spending for October. The consensus is for a 0.3% increase in construction spending.

10:00 AM ET: ISM Manufacturing Index for November. The consensus is for a slight increase to 51.7 from 50.8 in October.

All day: Light vehicle sales for November. Light vehicle sales are expected to increase to 13.4 million (Seasonally Adjusted Annual Rate), from 13.2 million in October.

8:30 AM: Employment Report for November.

The consensus is for an increase of 112,000 non-farm payroll jobs in November, up from the 80,000 jobs added in October.

The consensus is for an increase of 112,000 non-farm payroll jobs in November, up from the 80,000 jobs added in October. This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The consensus forecast for November is in blue.

The consensus is for the unemployment rate to remain at 9.0% in November.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through October.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through October. Through the first ten months of 2011, the economy has added 1.256 million total non-farm jobs or just 125 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.47 million fewer payroll jobs than at the beginning of the 2007 recession. The economy has added 1.529 million private sector jobs this year, or about 153 thousand per month.

Summary for Week Ending Nov 25th

by Calculated Risk on 11/26/2011 08:23:00 AM

It was a short holiday week, but the key story remained the same: the European situation continues to deteriorate as European policymakers fiddle. Europe continues to overshadow the U.S. economic situation and the European financial crisis continues to pose the greatest downside risk to the U.S. economy. I'll have more on Europe later ...

In the U.S., the economic data continues to indicate sluggish growth. Q3 GDP was revised down to 2.0% annualized from the advance report of 2.5%, however most of the downward revision was due to a large decline in the "change in real private inventories" - not final demand.

Personal spending slowed in October, although personal income picked up a little. The four week average of initial weekly unemployment claims is below 400,000, and at the lowest level since early April. This suggests some improvement in the labor market in November.

For manufacturing, the Richmond Fed survey showed activity was unchanged in November (after contracting in five out of the last six months), and the Kansas City survey showed sluggish expansion.

Two other items of interest: The Federal Reserve released the annual stress test scenario for the largest banks (with significant declines for the stock market and house prices), and the FOMC minutes showed the FOMC might consider providing the "likely future path of the target federal funds rate".

Here is a summary in graphs:

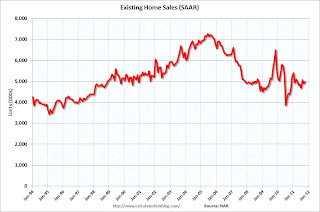

• Existing Home Sales in October: 4.97 million SAAR, 8.0 months of supply

The NAR reported: October Existing-Home Sales Rise, Unsold Inventory Continues to Decline

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October 2011 (4.97 million SAAR) were 1.4% higher than last month, and were 13.5% above the October 2010 rate.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 13.8% year-over-year in October from October 2010. This is the ninth consecutive month with a YoY decrease in inventory.

Inventory decreased 13.8% year-over-year in October from October 2010. This is the ninth consecutive month with a YoY decrease in inventory.

Months of supply decreased to 8.0 months in October, down from 8.3 months in September. This is still higher than normal. These sales numbers were just above the consensus.

• Personal Income increased 0.4% in October, Spending increased 0.1%

The BEA released the Personal Income and Outlays report for October:

The BEA released the Personal Income and Outlays report for October: Personal income increased $48.1 billion, or 0.4 percent ... in October, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $8.2 billion, or 0.1 percent.This graph shows real Personal Consumption Expenditures (PCE) through October (2005 dollars).

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in October, compared with an increase of 0.5 percent in September. ... PCE price index -- The price index for PCE decreased 0.1 percent in October, in contrast to an increase of 0.2 percent in September.

PCE increased 0.1% in October, and real PCE increased 0.1%.

Note: The PCE price index, excluding food and energy, increased 0.1 percent.

In October, income increased faster than spending - reversing a recent trend - and the saving rate increased slightly. However the saving rate has declined sharply over the last few months. Personal income was slightly better than expected, and spending a little lower than expectations.

• Weekly Initial Unemployment Claims at 393,000

The DOL reports:

The DOL reports:In the week ending November 19, the advance figure for seasonally adjusted initial claims was 393,000, an increase of 2,000 from the previous week's revised figure of 391,000. The 4-week moving average was 394,250, a decrease of 3,250 from the previous week's revised average of 397,500.

This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 394,250.

This is the lowest level for the 4 week average since early April - although this is still elevated.

• FDIC-insured institutions’ 1-4 Family Real Estate Owned (REO) decreased in Q3

The FDIC released the Quarterly Banking Profile for Q3. The report showed that 1-4 family Real Estate Owned (REO) by FDIC insured institutions declined to $11.9 billion in Q3, from $12.1 billion in Q2 - and from a record $14.76 billion in Q3 2010.

As economist Tom Lawler has pointed out before, the FDIC does not collect data on the number of properties held by FDIC-insured institutions, instead they aggregate the carrying value of 1-4 family residential REO on FDIC-insured institutions’ balance sheets.

Using an average of $150,000 per unit would suggest the number of 1-4 family REOs declined from 80,597 in Q2 to 79,335 in Q3.

Here is a graph of the 1-4 family REO carrying value for FDIC insured institutions since Q1 2003.

Here is a graph of the 1-4 family REO carrying value for FDIC insured institutions since Q1 2003. The left scale is the dollars reported in the FDIC Quarterly Banking Profile, and the right scale is an estimate of REOs using an average of $150,000 per unit. Using this estimate for the average per REO gives 79.3 thousand REO at the end of Q3.

Note: FDIC insured institutions have other REO and this is just the 1-4 family residential REO (other REO includes Construction & Development, Multi-family, Commercial, Farm Land).

Of course this is just a small portion of the total 1-4 family REO.

• ATA Trucking Index increased 0.5% in October

From ATA: ATA Truck Tonnage Index Rose 0.5% in October

From ATA: ATA Truck Tonnage Index Rose 0.5% in OctoberThe American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 0.5% in October after rising a revised 1.5% in September 2011.”Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. This index has started increasing again after stalling earlier this year - however this is still fairly sluggish growth.

• Moody's: Commercial Real Estate Prices declined 1.4% in September

From Dow Jones: Moody's: Commercial Real-Estate Prices Fell In September

From Dow Jones: Moody's: Commercial Real-Estate Prices Fell In SeptemberU.S. commercial real-estate prices fell 1.4% in September, ending a four-month growth streak."Here is a graph of the Moodys/REAL Commercial Property Price Index (CPPI). CRE prices only go back to December 2000.

According to Moody's, CRE prices are up 1.3% from a year ago, and down about 42% from the peak in 2007. This index is very volatile because there are relatively few transactions - but it does appear to be mostly moving sideways.

• Final November Consumer Sentiment at 64.1

The final November Reuters / University of Michigan consumer sentiment index declined to 64.1 from the preliminary reading of 64.2, up from the October reading of 60.9, and up from 55.7 in August.

The final November Reuters / University of Michigan consumer sentiment index declined to 64.1 from the preliminary reading of 64.2, up from the October reading of 60.9, and up from 55.7 in August.Consumer sentiment is usually impacted by employment (and the unemployment rate) and gasoline prices. But right now the European financial crisis is probably also impacting sentiment.

Although sentiment is up from October, this is still very weak, and slightly below the consensus forecast of 64.6.

• Other Economic Stories ...

• Q3 real GDP growth revised down to 2.0% annualized rate

• FOMC Minutes: Discussion of providing "likely future path of the target federal funds rate"

• Fed outlines new bank supervisory stress test

• From the Kansas City Fed: Growth in Manufacturing Activity Eased Slightly

• From the Richmond Fed: Manufacturing Activity Steadied in November; Expectations Were Upbeat

• State Unemployment Rates "little changed or slightly lower" in October

• DOT: Vehicle Miles Driven declined 1.5% in September

• Chicago Fed: Economic activity up slightly in October

Friday, November 25, 2011

Unofficial Problem Bank list increases to 980 institutions

by Calculated Risk on 11/25/2011 09:04:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 25, 2011. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Happy Thanksgiving to all our readers!CR Note: Thanks to surferdude808! Earlier this week, the WSJ reported that Bank of America was warned by regulators of a possible formal action if the bank doesn't make progress. That would be a huge addition to the Unofficial Problem Bank list!

The FDIC did not deliver a "Black Friday" to any bank today as they let their closing teams enjoy a long weekend off. Still, there were a number of changes to the Unofficial Problem Bank List as the OCC and FDIC released their enforcement actions for the past month this week. As a result, there were seven additions and four removals, which leave the list with 980 institutions with assets of $400.5 billion. A year ago, there were 919 institutions with assets of $410 billion.

During this month, the list fell by a net five institutions with changes including eight additions, four failures, two unassisted mergers, and seven cures. Positively, it is the fifth consecutive monthly decline; however, the list has only declined by a net 21 institutions with failure causing 40 removals over this span.

The removals this week were all cures and include Commercial National Bank of Texarkana, Texarkana, TX ($191 million); The National Bank of Waupun, Waupun, WI ($126 million); Texas National Bank, Mercedes, TX ($92 million); and First National Bank of the Lakes, Navarre, MN ($61 million).

Among the seven additions are First Community Bank, Santa Rosa, CA ($698 million); CoastalStates Bank, Hilton Head Island, SC ($372 million); Commerce Bank, Geneva, MN ($207 million); and Regal Bank & Trust, Owings Mills, MD ($182 million Ticker: RGBM).

The OCC and FDIC replaced a number of existing outstanding actions during the past month. The other change of note is a Prompt Corrective Action Order issued by the OCC against Western National Bank, Phoenix, AZ ($163 million).

Gasoline Prices and Brent WTI Spread

by Calculated Risk on 11/25/2011 03:10:00 PM

According to Bloomberg, Brent Crude is down to $106.40 per barrel, while WTI is up to $96.77. The spread has been narrowing for over a month, especially following the recent announcement of a partial reversal of the Seaway pipeline to transport crude oil from Cushing, Oklahoma, to the Gulf Coast.

If the global economy really slows, oil and gasoline prices will probably fall - and probably offset some of the impact from lower exports. There hasn't been a sharp decline in world oil prices yet.

Click on graph for larger image.

Click on graph for larger image.

This graphs shows the prices for Brent and WTI over the last few years. Usually the prices track pretty closely, but the "glut" of oil at Cushing pushed down WTI prices relative to Brent. Now the gap is closing (the pipeline is scheduled to be reversed in Q2 2012).

On a longer term basis, here is a little good news for Bloomberg: Renewable power trumps fossil fuels for first time

Renewable energy is surpassing fossil fuels for the first time in new power-plant investments, shaking off setbacks from the financial crisis and an impasse at the United Nations global warming talks.And here is a graph of gasoline prices. Gasoline prices have been slowly moving down since peaking in early May as the shown on the graph below. Note: The graph below shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

Electricity from the wind, sun, waves and biomass drew $187 billion last year compared with $157 billion for natural gas, oil and coal, according to calculations by Bloomberg New Energy Finance using the latest data. Accelerating installations of solar- and wind-power plants led to lower equipment prices, making clean energy more competitive with coal.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |