by Calculated Risk on 11/06/2011 01:50:00 PM

Sunday, November 06, 2011

Retail: Seasonal Hiring vs. Retail Sales

On Friday I noted that retailers hired seasonal workers at close to the pre-crisis pace in October. Reader Hd asked about the correlation between seasonal hiring and retail sales. Below is a scatter graph of historical October retail hiring vs. the real increase in retail sales.

First, here is the NRF forecast for this year: NRF Forecasts Holiday Sales Increase of 2.8 Percent to $465.6 Billion

The 2011 holiday season can be summed up in one word: average. On the heels of a holiday season that outperformed most analysts’ expectations, holiday retail sales for 2011 are expected to increase 2.8 percent to $465.6 billion, according to the National Retail Federation. While that growth is far lower than the 5.2 percent increase retailers experienced last year, it is slightly higher than the ten-year average holiday sales increase of 2.6 percent.Here is a repeat of the graph of retail hiring based on the BLS employment report:

...

NRF used its holiday forecasting model to create a projection for seasonal hiring in retail. According to NRF, retailers are expected to hire between 480,000 and 500,000 seasonal workers this holiday season, which is comparable to the 495,000 seasonal employees they hired last year.

...

Retail industry sales include most traditional retail categories including discounters, department stores, grocery stores, and specialty stores, and exclude sales at automotive dealers, gas stations, and restaurants.

Click on graph for larger image.

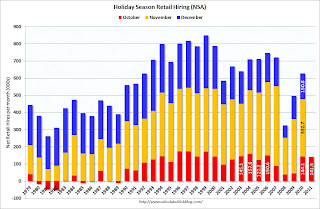

Click on graph for larger image.This graph shows the historical net retail jobs added for October, November and December by year.

Retailers hired 141.5 thousand workers (NSA) net in October. This is about the same level as in 2003 through 2006 and the same as in 2010. Note: this is NSA (Not Seasonally Adjusted).

The scatter graph is for the years 1993 through 2010 and compares October retail hiring with the real increase (inflation adjusted) for retail sales (Q4 over previous Q4).

The scatter graph is for the years 1993 through 2010 and compares October retail hiring with the real increase (inflation adjusted) for retail sales (Q4 over previous Q4).In general October hiring is a pretty good indicator of seasonal sales. R-square is 0.69 for this small sample. Note: This uses retail sales in Q4, and excludes autos, gasoline and restaurants.

This suggests a real gain of around 2.5% in Q4 (plus inflation), well above the NRF forecast of 2.8% nominal (including inflation).

However November is the key month for seasonal retail hiring, and if retailers hire 330,000+ seasonal workers in November like last year, this retail season will probably be solid.