by Calculated Risk on 11/26/2011 08:23:00 AM

Saturday, November 26, 2011

Summary for Week Ending Nov 25th

It was a short holiday week, but the key story remained the same: the European situation continues to deteriorate as European policymakers fiddle. Europe continues to overshadow the U.S. economic situation and the European financial crisis continues to pose the greatest downside risk to the U.S. economy. I'll have more on Europe later ...

In the U.S., the economic data continues to indicate sluggish growth. Q3 GDP was revised down to 2.0% annualized from the advance report of 2.5%, however most of the downward revision was due to a large decline in the "change in real private inventories" - not final demand.

Personal spending slowed in October, although personal income picked up a little. The four week average of initial weekly unemployment claims is below 400,000, and at the lowest level since early April. This suggests some improvement in the labor market in November.

For manufacturing, the Richmond Fed survey showed activity was unchanged in November (after contracting in five out of the last six months), and the Kansas City survey showed sluggish expansion.

Two other items of interest: The Federal Reserve released the annual stress test scenario for the largest banks (with significant declines for the stock market and house prices), and the FOMC minutes showed the FOMC might consider providing the "likely future path of the target federal funds rate".

Here is a summary in graphs:

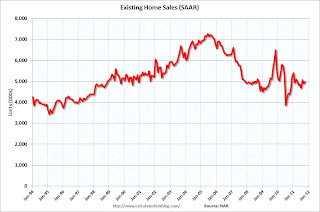

• Existing Home Sales in October: 4.97 million SAAR, 8.0 months of supply

The NAR reported: October Existing-Home Sales Rise, Unsold Inventory Continues to Decline

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October 2011 (4.97 million SAAR) were 1.4% higher than last month, and were 13.5% above the October 2010 rate.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 13.8% year-over-year in October from October 2010. This is the ninth consecutive month with a YoY decrease in inventory.

Inventory decreased 13.8% year-over-year in October from October 2010. This is the ninth consecutive month with a YoY decrease in inventory.

Months of supply decreased to 8.0 months in October, down from 8.3 months in September. This is still higher than normal. These sales numbers were just above the consensus.

• Personal Income increased 0.4% in October, Spending increased 0.1%

The BEA released the Personal Income and Outlays report for October:

The BEA released the Personal Income and Outlays report for October: Personal income increased $48.1 billion, or 0.4 percent ... in October, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $8.2 billion, or 0.1 percent.This graph shows real Personal Consumption Expenditures (PCE) through October (2005 dollars).

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in October, compared with an increase of 0.5 percent in September. ... PCE price index -- The price index for PCE decreased 0.1 percent in October, in contrast to an increase of 0.2 percent in September.

PCE increased 0.1% in October, and real PCE increased 0.1%.

Note: The PCE price index, excluding food and energy, increased 0.1 percent.

In October, income increased faster than spending - reversing a recent trend - and the saving rate increased slightly. However the saving rate has declined sharply over the last few months. Personal income was slightly better than expected, and spending a little lower than expectations.

• Weekly Initial Unemployment Claims at 393,000

The DOL reports:

The DOL reports:In the week ending November 19, the advance figure for seasonally adjusted initial claims was 393,000, an increase of 2,000 from the previous week's revised figure of 391,000. The 4-week moving average was 394,250, a decrease of 3,250 from the previous week's revised average of 397,500.

This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 394,250.

This is the lowest level for the 4 week average since early April - although this is still elevated.

• FDIC-insured institutions’ 1-4 Family Real Estate Owned (REO) decreased in Q3

The FDIC released the Quarterly Banking Profile for Q3. The report showed that 1-4 family Real Estate Owned (REO) by FDIC insured institutions declined to $11.9 billion in Q3, from $12.1 billion in Q2 - and from a record $14.76 billion in Q3 2010.

As economist Tom Lawler has pointed out before, the FDIC does not collect data on the number of properties held by FDIC-insured institutions, instead they aggregate the carrying value of 1-4 family residential REO on FDIC-insured institutions’ balance sheets.

Using an average of $150,000 per unit would suggest the number of 1-4 family REOs declined from 80,597 in Q2 to 79,335 in Q3.

Here is a graph of the 1-4 family REO carrying value for FDIC insured institutions since Q1 2003.

Here is a graph of the 1-4 family REO carrying value for FDIC insured institutions since Q1 2003. The left scale is the dollars reported in the FDIC Quarterly Banking Profile, and the right scale is an estimate of REOs using an average of $150,000 per unit. Using this estimate for the average per REO gives 79.3 thousand REO at the end of Q3.

Note: FDIC insured institutions have other REO and this is just the 1-4 family residential REO (other REO includes Construction & Development, Multi-family, Commercial, Farm Land).

Of course this is just a small portion of the total 1-4 family REO.

• ATA Trucking Index increased 0.5% in October

From ATA: ATA Truck Tonnage Index Rose 0.5% in October

From ATA: ATA Truck Tonnage Index Rose 0.5% in OctoberThe American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 0.5% in October after rising a revised 1.5% in September 2011.”Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. This index has started increasing again after stalling earlier this year - however this is still fairly sluggish growth.

• Moody's: Commercial Real Estate Prices declined 1.4% in September

From Dow Jones: Moody's: Commercial Real-Estate Prices Fell In September

From Dow Jones: Moody's: Commercial Real-Estate Prices Fell In SeptemberU.S. commercial real-estate prices fell 1.4% in September, ending a four-month growth streak."Here is a graph of the Moodys/REAL Commercial Property Price Index (CPPI). CRE prices only go back to December 2000.

According to Moody's, CRE prices are up 1.3% from a year ago, and down about 42% from the peak in 2007. This index is very volatile because there are relatively few transactions - but it does appear to be mostly moving sideways.

• Final November Consumer Sentiment at 64.1

The final November Reuters / University of Michigan consumer sentiment index declined to 64.1 from the preliminary reading of 64.2, up from the October reading of 60.9, and up from 55.7 in August.

The final November Reuters / University of Michigan consumer sentiment index declined to 64.1 from the preliminary reading of 64.2, up from the October reading of 60.9, and up from 55.7 in August.Consumer sentiment is usually impacted by employment (and the unemployment rate) and gasoline prices. But right now the European financial crisis is probably also impacting sentiment.

Although sentiment is up from October, this is still very weak, and slightly below the consensus forecast of 64.6.

• Other Economic Stories ...

• Q3 real GDP growth revised down to 2.0% annualized rate

• FOMC Minutes: Discussion of providing "likely future path of the target federal funds rate"

• Fed outlines new bank supervisory stress test

• From the Kansas City Fed: Growth in Manufacturing Activity Eased Slightly

• From the Richmond Fed: Manufacturing Activity Steadied in November; Expectations Were Upbeat

• State Unemployment Rates "little changed or slightly lower" in October

• DOT: Vehicle Miles Driven declined 1.5% in September

• Chicago Fed: Economic activity up slightly in October