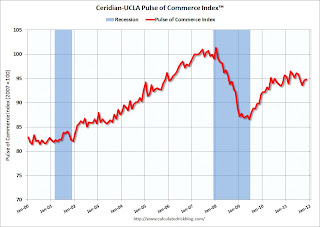

The Ceridian-UCLA Pulse of Commerce Index®(PCI®), issued today by the UCLA Anderson School of Management and Ceridian Corporation, rose 0.1 percent in November following a 1.1 percent increase in October.

On a year-over-year basis, the PCI grew 0.9 percent in November compared to the 1.3 percent year-over-year increase in October. “The continuing weakness in the PCI is out-of-sync with real retail sales. The year-over-year increase in real retail sales through October was 3.6 percent compared with an increase in the PCI of 1.3 percent. The disconnect between real retail sales and the PCI suggests that retailers have learned to better manage their inventory. Therefore, shoppers can anticipate fewer bargains in the month ahead, and relatively little stock left for the after-Christmas sales,” said Ed Leamer, chief economist for the Ceridian-UCLA Pulse of Commerce Index and director of the UCLA Anderson Forecast.

...

Based on the latest PCI data, our forecast for November Industrial Production is a 0.06 percent increase when the government estimate is released on December 15.

Click on graph for larger image.

Click on graph for larger image.This graph shows the index since January 2000.

This index declined sharply in late summer and has only partially rebounded over the last two months. Mostly this has been sideways this year (only up 0.9% from November 2010).

Note: This index does appear to track Industrial Production over time (with plenty of noise).