by Calculated Risk on 12/15/2011 04:24:00 PM

Thursday, December 15, 2011

Lawler on FHA: Slow Pace of Conveyances, Solid Sales Pushes SF Inventory to Lowest Level since mid-2008

CR Note: The FHA has some "issues" and just released the September (Q3) REO data. I've update the Q3 REO graphs (see bottom of this post).

From economist Tom Lawler:

The FHA finally addressed the “issues” delaying the release of the September Report to the FHA Commissioner, and even released the October report this week.

On the SF REO front, the continued slow pace of property conveyances (partly related to the foreclosure “mess”), combined with a decent pace of sales, pushed the FHA’s SF REO inventory down to an estimated 37,922 at the end of October, the lowest level since mid-2008. I say “estimated” because the numbers in this report don’t always exactly “jive” with other FHA data not regularly released to the public. Here is a table with some history of data from various monthly reports.

| Monthly Report to FHA Commissioner | ||||

|---|---|---|---|---|

| SF REO Inventory (EOM) | Conveyances | Sales | Adjustments | |

| Jun-10 | 44,850 | 8,487 | 8,893 | 41 |

| Jul-10 | 44,944 | 8,341 | 8,508 | 261 |

| Aug-10 | 47,007 | 9,810 | 7,686 | -61 |

| Sep-10 | 51,487 | 11,411 | 7,439 | 508 |

| Oct-10 | 54,609 | 9,908 | 7,289 | 503 |

| Nov-10 | 55,488 | 6,752 | 5,817 | -56 |

| Dec-10 | 60,739 | 7,728 | 2,749 | 272 |

| Jan-11 | 65,639 | 7,709 | 2,632 | -177 |

| Feb-11 | 68,801 | 7,383 | 4,221 | 0 |

| Mar-11 | 68,997 | 8,647 | 8,728 | 277 |

| Apr-11 | 65,063 | 7,410 | 11,375 | 31 |

| May-11 | 59,465 | 7,032 | 12,659 | 29 |

| Jun-11 | 53,164 | 7,240 | 13,600 | 59 |

| Jul-11 | 48,507 | 6,509 | 11,379 | 213 |

| Aug-11 | 44,749 | 8,005 | 11,701 | -62 |

| Sep-11 | 40,719 | 6,567 | 10,554 | -43 |

| Oct-11 | 37,922 | 6,541 | 9,883 | 545 |

The shockingly slow sales pace in the latter part of 2010 and the early part of 2011 reflected contract changes for managing FHA property sales.

What is especially striking is the extraordinarily low level of property conveyances in September and October, especially given the continued increase in the number of FHA-insured SF loans that are seriously delinquent.

The latest report also showed a substantial slowdown in the number of SF FHA loan modifications over the past few months.

| FHA SF "Home Retention" Activity | |||||

|---|---|---|---|---|---|

| Forbearance Agreements | Loan Modifications | Partial Claims | Total "Loss Mitigation Activity" | SDQ Loans | |

| Dec-09 | 1,840 | 8,514 | 968 | 11,322 | 549,667 |

| Jan-10 | 1,766 | 9,319 | 986 | 12,071 | 576,691 |

| Feb-10 | 1,618 | 11,359 | 846 | 13,823 | 570,799 |

| Mar-10 | 1,686 | 14,604 | 1,158 | 17,448 | 553,650 |

| Apr-10 | 1,228 | 11,525 | 1,603 | 14,356 | 544,464 |

| May-10 | 1,189 | 12,034 | 1,621 | 14,844 | 548,193 |

| Jun-10 | 1,074 | 17,072 | 1,479 | 19,625 | 551,330 |

| Jul-10 | 1,212 | 19,002 | 1,421 | 21,635 | 559,620 |

| Aug-10 | 1,152 | 16,090 | 1,676 | 18,918 | 558,316 |

| Sep-10 | 1,070 | 15,634 | 1,520 | 18,224 | 563,513 |

| Oct-10 | 2,361 | 12,667 | 1,194 | 16,222 | 532,938 |

| Nov-10 | 1,720 | 14,830 | 1,631 | 18,181 | 588,947 |

| Dec-10 | 3,301 | 18,000 | 2,328 | 23,629 | 598,140 |

| Jan-11 | 2,905 | 12,075 | 2,352 | 17,332 | 612,443 |

| Feb-11 | 2,628 | 10,412 | 1,991 | 15,031 | 619,712 |

| Mar-11 | 3,562 | 12,752 | 2,714 | 19,028 | 553,650 |

| Apr-11 | 2,503 | 13,564 | 2,366 | 18,433 | 575,950 |

| May-11 | 2,211 | 11,945 | 3,377 | 17,533 | 578,933 |

| Jun-11 | 2,655 | 13,368 | 3,082 | 19,105 | 584,822 |

| Jul-11 | 2,259 | 8,075 | 1,629 | 11,963 | 598,921 |

| Aug-11 | 2,068 | 9,950 | 1,815 | 13,833 | 611,822 |

| Sep-11 | 1,581 | 7,346 | 1,501 | 10,428 | 635,096 |

| Oct-11 | 2,109 | 7,183 | 1,426 | 10,718 | 661,554 |

Here is a table showing FHA SF insurance claims for the past few fiscal years (October to September), as well as for October 2011.

| Insurance Claims | 11-Oct | FY 2011 | FY 2010 | FY 2009 |

|---|---|---|---|---|

| Conveyance Foreclosure | 6,649 | 90,340 | 98,868 | 69,009 |

| Pre-Foreclosure Sale | 4,435 | 25,069 | 15,293 | 6,473 |

| Deed-in-Lieu of Foreclosure | 106 | 1,132 | 863 | 835 |

| Other | 48 | 1,646 | 152 | 102 |

| Total | 11,238 | 118,187 | 115,176 | 76,419 |

In its 2011 report to Congress on the financial status of the FHA Mutual Mortgage Insurance fund, HUD noted that the “so-called ‘robo-signing’ crisis” had “created a lengthening of time-in-foreclosure for FHA-insured loans” that produced a drop in conveyance foreclosures and a surge in “open cases,” the final resolution of which was “still to be determined.” Clearly, the pace of conveyance foreclosures continued to be “artificially” depressed in October. FHA pre-foreclosure sales activity surged last year, and October was a record month for pre-foreclosure sales.

CR Note: The above was from Tom Lawler, below are update to REO graphs.

Click on graph for larger image.

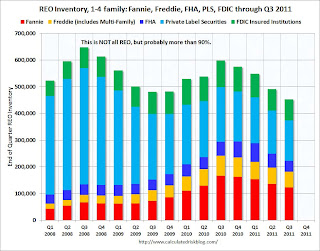

Click on graph for larger image.This graph shows the REO inventory for Fannie, Freddie and FHA through Q3 2011.

The REO inventory for the "Fs" increased sharply in 2010, but may have peaked in Q4 2010. However there may be a new peak when the foreclosure dam breaks (after the settlement) - however I expect quite a few modifications as part of the settlement too, and probably a bulk REO selling program from Fannie and Freddie.

The Fannie, Freddie, FHA, PLS, FDIC REO decreased to about 455,000 in Q3 from just under 500,000 in Q2.

The Fannie, Freddie, FHA, PLS, FDIC REO decreased to about 455,000 in Q3 from just under 500,000 in Q2.As Tom Lawler has noted: "This is NOT an estimate of total residential REO, as it excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts, and a few other lender categories." However this is the bulk of the 1-4 family REO - probably 90% or more. Rounding up the estimate (using 90%) suggests total REO is just around 500,000 in Q3.

Important: REO inventories have declined over the last year. This is a combination of more sales and fewer acquisitions due to the slowdown in the foreclosure process. There are many more foreclosures coming - see my post last month Housing: REO and Mortgage Delinquencies.