by Calculated Risk on 12/07/2011 08:52:00 AM

Wednesday, December 07, 2011

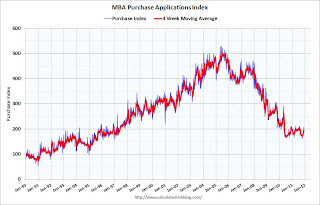

MBA: Mortgage Purchase Application Index increased

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 15.3 percent from the previous week. The seasonally adjusted Purchase Index increased 8.3 percent from one week earlier to its highest level since August 5, 2011.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Coming out of the Thanksgiving holiday, applications increased significantly as mortgage rates dropped to their lowest levels in about two months," said Michael Fratantoni, MBA's Vice President of Research and Economics. "In particular, refinance applications increased sharply, with some lenders seeing refinance volume double. Despite this surge, aggregate refinance activity is still below levels reported two weeks ago. Some lenders indicated they are beginning to see an increase in HARP loans, but that increase is still a small portion of the move this week."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.18 percent, the lowest rate since September 30, 2011 ...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500)decreased to 4.52 percent, the lowest rate since September 30, 2011 ...

Click on graph for larger image.

Click on graph for larger image.Although the purchase index increased, the index has mostly been sideways for the last 2 years - and at about the same level as in 1997.