Small-business optimism rose for the third consecutive month, gaining 1.8 points in November, and settling at a still weak 92.0, according to the National Federation of Independent Business’ (NFIB’s) latest index. ... Optimism appears to have climbed because fewer owners expect business conditions or sales to be worse in six months, indicating some hope on the horizon. Improvement, although small, was widespread with the forward-looking components indicating positive trends for the first time in many months.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

“After so many months of pessimism, November’s modest gain made it feel like spring, again,” said NFIB Chief Economist Bill Dunkelberg. “We have good reason to be optimistic about last month’s report and hopeful about what it means for the future."

Click on graph for larger image.

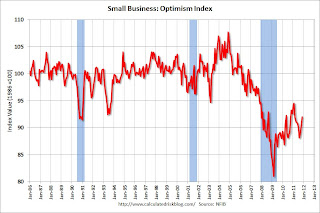

Click on graph for larger image.The first graph shows the small business optimism index since 1986. The index increased to 92.0 in November from 90.2 in October. This is the third increase in a row after declining for six consecutive months.

The second graph shows the net hiring plans for the next three months.

Hiring plans were still fairly low in November, but the trend is up - and this is the strongest reading in 38 months.

Hiring plans were still fairly low in November, but the trend is up - and this is the strongest reading in 38 months. According to NFIB: “The employment picture brightened last month, ending five months of decline. In November, NFIB owners reported an overall increase in employment of 0.12 workers per firm in November. ... Future hiring plans were also positive. Over the next three months, a seasonally adjusted net seven percent of owners plan to create new jobs—a 4 point improvement from October and the strongest reading in 38 months."

Twenty five percent of small business owners reported that weak sales continued to be their top business problem in November.

In good times, owners usually report taxes and regulation as their biggest problems.

In good times, owners usually report taxes and regulation as their biggest problems.The optimism index declined sharply in August due to the debt ceiling debate and only rebounded modestly over the last three months. This index has been slow to recover - probably due to a combination of sluggish growth, and the high concentration of real estate related companies in the index.