• Summary for Week ending Dec 9th

Retail sales for November is the key report this week. For manufacturing, the December NY Fed (Empire state) and Philly Fed surveys, and the November Industrial Production and Capacity Utilization report will be released on Thursday.

On prices, the November Producer Price index (PPI) will be released Thursday, and CPI will be released on Friday. Also - there is an FOMC meeting on Tuesday.

No releases scheduled.

7:30 AM: NFIB Small Business Optimism Index for November.

7:30 AM: NFIB Small Business Optimism Index for November. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index increased to 90.2 in October from 88.9 in September. The index has increased for two consecutive months and is expected to increase further in November.

8:30 AM: Retail Sales for November.

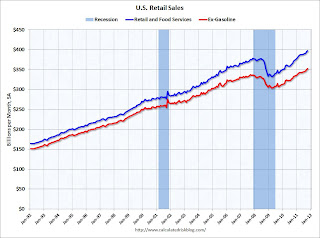

8:30 AM: Retail Sales for November. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 19.5% from the bottom, and now 5.1% above the pre-recession peak (not inflation adjusted).

The consensus is for retail sales to increase 0.5% in November, and for retail sales ex-autos to increase 0.4% .

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for November (a measure of transportation).

10:00 AM: Manufacturing and Trade: Inventories and Sales for October. The consensus is for a 0.6% increase in inventories.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

In general, the number of job openings (yellow) has been trending up, and are up about 22% year-over-year compared to September 2010.

2:15 PM: FOMC Meeting Announcement. No changes are expected to interest rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak since early August, although this doesn't include cash buyers.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 390,000 from 381,000 last week. The 4-week average has recently declined to slightly below 400,000.

8:30 AM: Producer Price Index for November. The consensus is for a 0.2% increase in producer prices (0.2% increase in core).

8:30 AM ET: NY Fed Empire Manufacturing Survey for December. The consensus is for a reading of +3.0, up from +0.61 in November (above zero is expansion).

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for November. The second graph shows industrial production since 1967. Industrial production increased in October to 94.7 The consensus is for a 0.2% increase in Industrial Production in November, and for no change at 77.8% for Capacity Utilization.

10:00 AM: Philly Fed Survey for December. The consensus is for a reading of 5.0 (above zero indicates expansion, up slightly from 3.6 last month.

8:30 AM: Consumer Price Index for November. The consensus is a 0.1% increase in prices. The consensus for core CPI is also an increase of 0.1%.