The good news included fewer initial weekly unemployment claims, an increase in consumer sentiment and an increase in rail traffic. However the ISM non-manufacturing index was weaker than expected, and - of course - house prices continued to decline.

Also, the data this week had implications for Q4 GDP, from Goldman Sachs:

[D]ata on inventories in the manufacturing and wholesale sectors was much stronger than expected for October. We now expect a modest inventory build in Q4 instead of a contraction. [I]mport growth was weaker than expected (because imports are subtracted from GDP, this is a positive). ... We revised up our tracking estimate for the quarter by nine tenths from 2.5% (annualized) at the start of the week to 3.4% currently.However, Goldman still expects growth to slow in the first half of 2012 to around 1%, due to spillover from the Euro-area crisis, and from U.S. fiscal tightening.

Here is a summary of last week in graphs:

• Trade Deficit declined in October

The Department of Commerce reported:

[T]otal October exports of $179.2 billion and imports of $222.6 billion resulted in a goods and services deficit of $43.5 billion, down from $44.2 billion in September,

revised. October exports were $1.5 billion less than September exports of $180.6 billion. October imports were $2.2 billion less than September imports of $224.8 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows the monthly U.S. exports and imports in dollars through October 2011.

Both exports and imports decreased in October. Imports have been mostly moving sideways for the past six months (seasonally adjusted) - partially due to slightly lower oil prices. Exports are well above the pre-recession peak and up 12% compared to October 2010; imports have stalled recently but are still up about 11% compared to October 2010.

• ISM Non-Manufacturing Index indicates slower expansion in November

The November ISM Non-manufacturing index was at 52.0%, down from 52.9% in October. The employment index decreased in November to 48.9%, down from 53.3% in October.

The November ISM Non-manufacturing index was at 52.0%, down from 52.9% in October. The employment index decreased in November to 48.9%, down from 53.3% in October. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 53.8% and indicates slower expansion in November than in October.

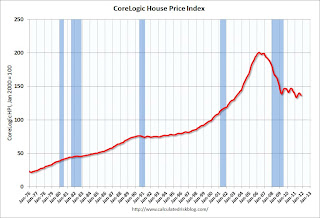

• CoreLogic: House Price Index declined 1.3% in October

CoreLogic released its October Home Price Index showing that "home prices in the U.S. decreased 1.3 percent on a month-over-month basis".

CoreLogic released its October Home Price Index showing that "home prices in the U.S. decreased 1.3 percent on a month-over-month basis".This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 1.3% in October, and is down 3.9% over the last year.

The index is off 32.0% from the peak - and up just 2.5% from the March 2011 low.

Some of this decrease is seasonal (the CoreLogic index is NSA). Month-to-month prices changes will probably remain negative through February or March 2012 - the normal seasonal pattern. It is likely that there will be new post-bubble lows for this index in early 2012.

• Labor Force Participation Rate

Three recent post on the labor force participation rate:

1) Comments on the Employment-Population Ratio

2) Labor Force Participation Rate by Age Group

3) Labor Force Participation Rate: The Kids are Alright

Here is a repeat of the graph showing the trends by age group since 1990.

Here is a repeat of the graph showing the trends by age group since 1990.Some of the recent decline in the participation rate for the '20 to 24' age group is probably related to the recession.

But probably the main reason for the decline in the participation rate for the younger age groups is that more people are pursuing higher education.

This graph uses data from the BLS on participation rate, and the National Center for Education Statistics (NCES) on enrollment rates.

This graph uses data from the BLS on participation rate, and the National Center for Education Statistics (NCES) on enrollment rates.This graph shows the participation and enrollment rates for the 18 to 19 year old age group. These two lines are a "mirror image".

Note: I added the participation rate for men and women too. One of the key labor stories in the 2nd half of the 1900s was the surge in participation by women.

In the long run, more education is a positive for the economy (although I am concerned about the surge in student loans).

• Weekly Initial Unemployment Claims decline to 381,000

"In the week ending December 3, the advance figure for seasonally adjusted initial claims was 381,000, a decrease of 23,000 from the previous week's revised figure of 404,000."

"In the week ending December 3, the advance figure for seasonally adjusted initial claims was 381,000, a decrease of 23,000 from the previous week's revised figure of 404,000."This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. This is the fourth week in a row with the 4-week average below 400,000, and this is the lowest level for claims since February.

• Consumer Sentiment increased in December

The preliminary December Reuters / University of Michigan consumer sentiment index increased to 67.7, up from the November reading of 64.1.

Consumer sentiment is usually impacted by employment (and the unemployment rate) and gasoline prices.

However the recent sharp decline was event driven (the debt ceiling debate), and sentiment has rebounded as expected. Note: Back in August I looked at event driven declines in consumer sentiment.

Sentiment is still very weak, although this was above the consensus forecast of 66.0.

• Other Economic Stories ...

• From LPS: LPS Home Price Index Shows 1.2 Percent Decline in September U.S. Home Prices; Early Data Suggests Further 1.1 Percent Drop in October Likely

• Research: New paper on the role of investors in the housing bubble

• Lawler on "Real Estate Investors, the Leverage Cycle, and the Housing Crisis"

• AAR: Rail Traffic increased in November