by Calculated Risk on 1/31/2012 09:00:00 AM

Tuesday, January 31, 2012

Case Shiller: House Prices fall to new post-bubble lows in November (seasonally adjusted)

S&P/Case-Shiller released the monthly Home Price Indices for November (a 3 month average of September, October, and November). This release includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Home Prices Continued to Decline in November 2011 According to the S&P/Case-Shiller Home Price Indices

Data through November 2011, released today by S&P Indices for its S&P/Case-Shiller1 Home Price Indices ... showed declines of 1.3% for both the 10- and 20-City Composites in November over October. For a second consecutive month, 19 of the 20 cities covered by the indices also saw home prices decrease. The 10- and 20-City composites posted annual returns of -3.6% and -3.7% versus November 2010, respectively. These are worse than the -3.2% and -3.4% respective rates reported for October.

“Despite continued low interest rates and better real GDP growth in the fourth quarter, home prices continue to fall. Weakness was seen as 19 of 20 cities saw average home prices decline in November over October,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “... Nationally, home prices are lower than a year ago. The 10-City Composite was down 3.6% and the 20-City was down 3.7% compared to November 2010. The trend is down and there are few, if any, signs in the numbers that a turning point is close at hand."

“The crisis low for the 10-City Composite was April 2009; for the 20-City Composite the more recent low was March 2011. The 10-City Composite is now about 1.0% above its low, and the 20-City Composite is only 0.6% above its low. From their 2006 peaks, both Composites are down close to 33% through November.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 33.5% from the peak, and down 0.7% in November (SA). The Composite 10 is at a new post bubble low (Seasonally adjusted), but still above the low NSA.

The Composite 20 index is off 33.5% from the peak, and down 0.7% in November (SA). The Composite 20 is also at a new post-bubble low.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.6% compared to November 2010.

The Composite 20 SA is down 3.7% compared to November 2010. This was a slightly larger year-over-year decline for both indexes than in October.

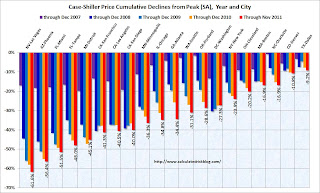

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 3 of the 20 Case-Shiller cities in November seasonally adjusted (only one city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.2% from the peak.

Prices increased (SA) in 3 of the 20 Case-Shiller cities in November seasonally adjusted (only one city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.2% from the peak.The NSA indexes are around 1% above the March 2011 lows - and these indexes will hit new lows in the next month or two since prices are falling again. Using the SA data, the Case-Shiller indexes are now at new post-bubble lows.