by Calculated Risk on 2/28/2012 02:53:00 PM

Tuesday, February 28, 2012

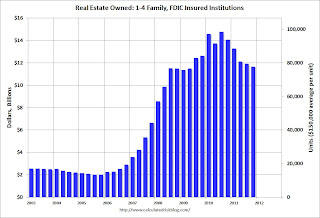

FDIC-insured institutions’ 1-4 Family Real Estate Owned (REO) decreased in Q4

The FDIC released the Quarterly Banking Profile today for Q4. The report showed that 1-4 family Real Estate Owned (REO) by FDIC insured institutions declined to $11.64 billion in Q4, from $11.9 billion in Q3 - and from $14.05 billion in Q4 2010.

As economist Tom Lawler has pointed out before, the FDIC does not collect data on the number of properties held by FDIC-insured institutions, instead they aggregate the carrying value of 1-4 family residential REO on FDIC-insured institutions’ balance sheets.

Using an average of $150,000 per unit would suggest the number of 1-4 family REOs declined from 79,335 in Q3 to 77,584 in Q4.

Here is a graph of the 1-4 family REO carrying value for FDIC insured institutions since Q1 2003.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The left scale is the dollars reported in the FDIC Quarterly Banking Profile, and the right scale is an estimate of REOs using an average of $150,000 per unit. Using this estimate for the average per REO gives 77.6 thousand REO at the end of Q4.

Note: FDIC insured institutions have other REO and this is just the 1-4 family residential REO (other REO includes Construction & Development, Multi-family, Commercial, Farm Land).

Of course this is just a small portion of the total 1-4 family REO. The FHA has already reported that REO declined sharply in Q4, and Fannie and Freddie are expected to report declines in REO later this week.

Although REO inventories declined over the last year - a combination of more sales and fewer acquisitions due to the slowdown in the foreclosure process - there are still many more foreclosures coming.