by Calculated Risk on 4/04/2012 09:00:00 AM

Wednesday, April 04, 2012

CoreLogic: House Price Index falls to new post-bubble low in February, Rate of decline slows

Notes: This CoreLogic House Price Index report is for February. The Case-Shiller index released last week was for January. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of the last three months and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® February Home Price Index Reports Month-Over-Month Increase, When Excluding Distressed Sales

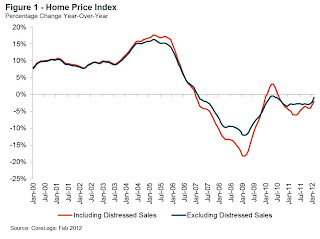

[CoreLogic February Home Price Index (HPI®) report] shows national home prices, including distressed sales, declined on a year-over-year basis by 2.0 percent in February 2012 and by 0.8 percent compared to January 2012, the seventh consecutive monthly decline.

Excluding distressed sales, month-over-month prices increased 0.7 percent in February from January. The CoreLogic HPI® also showed that year-over-year prices declined by 0.8 percent in February 2012 compared to February 2011. Distressed sales include short sales and real estate owned (REO) transactions.

“House prices, based on data through February, continue to decline, but at a decreasing rate. The deceleration in the pace of decline is a first step toward ultimately growing again,” said Mark Fleming, chief economist for CoreLogic. “Excluding distressed sales, we already see modest price appreciation month over month in January and February.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 0.8% in February, and is down 2.0% over the last year.

The index is off 34.4% from the peak - and is now at a new post-bubble low.

The second graph is from CoreLogic. As Mark Fleming noted, the year-over-year declines are getting smaller - this is the smallest year-over-year decline since 2010 when prices were impacted by the housing tax credit.

The second graph is from CoreLogic. As Mark Fleming noted, the year-over-year declines are getting smaller - this is the smallest year-over-year decline since 2010 when prices were impacted by the housing tax credit. Some of this decline was seasonal (the CoreLogic index is NSA) and month-to-month price changes will probably remain negative through March.