by Calculated Risk on 4/04/2012 03:05:00 PM

Wednesday, April 04, 2012

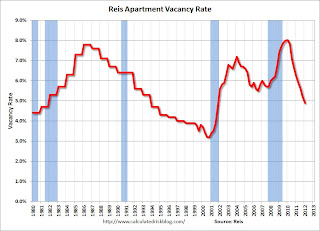

More: Apartment Vacancy Rate falls to 4.9% in Q1

Early this morning I noted that Reis reported the apartment vacancy rate (82 markets) fell to 4.9% in Q1 from 5.2% in Q4 2011. The vacancy rate was at 6.1% in Q1 2010 and peaked at 8.0% at the end of 2009.

Here are a few more comments and a long term graph from Reis.

Comments from Ries:

The strong performance of the apartment sector has yet to show signs of letting up; national vacancies fell by 30 basis points in the first quarter to 4.9%, a level last observed more than ten years ago, back in 4Q2001. It is also significant to note that national vacancies have improved beyond the benchmark 5% level used as a rule of thumb by apartment landlords: for most markets, once vacancies tighten below 5%, effective rents tend to spike as landlords perceive that tight market conditions allow for greater pricing power.

...

Net absorption, or the net change in occupied stock, remained strong, with 36,484 units leasing up. As the economy begins to show signs of slow but steady improvement, households are flocking to rentals as expectations of single‐family home prices remain flat over the next year or two.

...

With demand for rentals benefiting from the continued moribund state of the for‐sale housing market, tight supply conditions are helping boost the performance of apartment properties around the nation. Only 7,342 apartment units came online in the first quarter – the lowest quarterly figure for new completions since Reis began publishing quarterly data in 1999. Risks may manifest later in the year, however. With multifamily remaining one of the few shining starts in commercial real estate, developers have begun building properties to take advantage of rising incomes. Unless there are delays, Reis expects about 70,000 units to come online in 2012. That is about double the rate of supply growth in 2011. Even more units are slated to come online in 2013, somewhere in the order of 150,000 to 200,000 units in the 79 main markets that Reis tracks.

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980 (prior to 1999 the data is annual). Back in the early '80s, there was overbuilding in the apartment sector (just like for offices) with the very loose lending that led to the S&L crisis. Once the lending stopped, starts of built-for-rent units slowed, and the vacancy rate started to decline.

Following the financial crisis, starts and completions of multi-family units fell to record lows (there were a record low number of completions last year). Builders have increased construction, but it usually takes over a year to complete a multi-family building, so this new supply hasn't reached the market yet. As Reis noted, the number of completions will increase this year, but the vacancy rate will probably decline further.

This will also impact on house prices. The upward pressure on rents will make the price-to-rent ratio a little more favorable for buying.

Data courtesy of Reis.