by Calculated Risk on 5/24/2012 08:37:00 PM

Thursday, May 24, 2012

Record Low Mortgage Rates and Refinance Activity

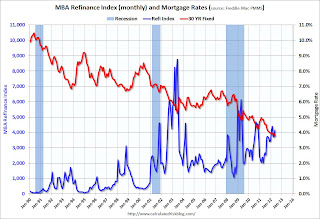

Below is a graph comparing mortgage rates from the Freddie Mac Primary Mortgage Market Survey® (PMMS®) and the refinance index from the Mortgage Bankers Association (MBA).

Freddie Mac reported earlier today that 30 year mortgage rates had fallen to a record 3.78% in the PMMS®.

And the MBA reported yesterday that refinance activity has been increasing again.

Earlier from Freddie Mac: Historic Lows for Fixed Mortgage Rates Hold Steady

30-year fixed-rate mortgage (FRM) averaged 3.78 percent with an average 0.8 point for the week ending May 24, 2012, down from last week when it averaged 3.79 percent. Last year at this time, the 30-year FRM averaged 4.60 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently at the record low for the last 40 years.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates are getting close! The 30 year conforming mortgage rates were at 4.23% in October 2010, so a 50 bps drop would be 3.73% - just below the current rate.

There has also been an increase in refinance activity from borrowers with negative equity and loans owned or guaranteed by Fannie or Freddie. As the MBA noted, the HARP share of refinance applications was 28 percent last week.