by Calculated Risk on 7/18/2012 07:04:00 AM

Wednesday, July 18, 2012

MBA: "Record Low Mortgage Rates Lead to Jump in Refinance Activity"

From the MBA: Record Low Mortgage Rates Lead to Jump in Refinance Activity

The Refinance Index increased 22 percent from the previous week and is at the highest level since mid-June. The seasonally adjusted Purchase Index decreased 0.1 percent from one week earlier.

“Refinance application volume increased last week to near peak levels for the year as mortgage rates dropped to a new low, driven down by growing concerns about the health of the US economy,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Applications for HARP refinance loans accounted for 24 percent of refinance activity last week, in line with the HARP share for the past few weeks.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.74 percent, the lowest rate in the history of the survey, from 3.79 percent, with points increasing to 0.45 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

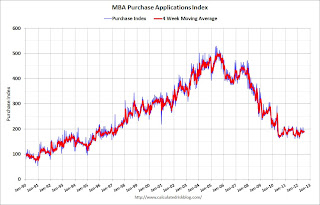

Click on graph for larger image.The first graph shows the purchase index, and the purchase index is mostly moving sideways over the last two years - but has been moving a little recently.

The second graph shows the refinance index.

This index is back to the high for the year.

This index is back to the high for the year.Some of the increase in the refinance index is related to HARP (HARP activity has picked up this year), but most of this activity is related to the record low mortgage rates.