by Calculated Risk on 8/25/2012 08:03:00 AM

Saturday, August 25, 2012

Summary for Week ending August 24th

The key sentence of the week was from the FOMC minutes of the last meeting: “Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery.”

“Substantial and sustainable”? Not any time soon. So the question is what is the meaning of “fairly soon”, and does that mean QE3, or an extension of the exceptionally low levels of interest rates until 2015?

We might get some hints next week when Fed Chairman Ben Bernanke speaks at the Jackson Hole Economic Symposium. But “fairly soon” probably means September ... for something!

The only significant economic releases this week were housing related – July new and existing home sales - and of course both were fairly positive.

For new homes, sales increased to 372,000 on an annual rate basis in July. New home sales have averaged a 360,000 pace through July, and that means sales are on pace to increase 18% from 2011 (with coming revisions, I expect sales to be up 20%+ this year). This is from a very low level, but how many sectors are seeing a 20% year-over-year increase in 2012?

For existing home sales, the key number is inventory. Although the NAR reported inventory increased slightly in July from June, inventory is still down 23.8% compared to July 2011. Another positive is that conventional sales in many areas are up sharply from last year, offsetting the decline in distressed sales.

Another key sentence (and an old theme for this blog): As goes housing, so goes the economy. The general rule is housing leads the economy – there are exceptions like in 2001 following the popping of the stock bubble, and recently we’ve seen a recovery without housing – but the housing recovery suggests, barring a significant policy mistake in the US or Europe, the pace of the economic recovery should increase in 2013. Will it be “substantial and sustainable”? I doubt it will be "substantial" in the near term.

Here is a summary of last week in graphs:

• New Home Sales increased in July to 372,000 Annual Rate

Click on graph for larger image.

Click on graph for larger image.

The Census Bureau reported New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 372 thousand. This was up from a revised 359 thousand SAAR in June (revised up from 350 thousand). Sales in May were revised down.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at a record low 38,000 units in July. The combined total of completed and under construction is at the lowest level since this series started.

This was another fairly solid report and indicates an ongoing sluggish recovery in residential investment.

• Existing Home Sales in July: 4.47 million SAAR, 6.4 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in July 2012 (4.47 million SAAR) were 2.3% higher than last month, and were 10.4% above the July 2011 rate.

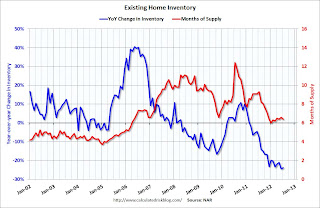

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 23% year-over-year in July from July 2011. This is the seventeenth consecutive month with a YoY decrease in inventory, and near the largest year-over-year decline reported.

Inventory decreased 23% year-over-year in July from July 2011. This is the seventeenth consecutive month with a YoY decrease in inventory, and near the largest year-over-year decline reported.Months of supply decreased to 6.4 months in July.

This was slightly below expectations of sales of 4.50 million. However, as I've noted before, those focusing on sales of existing homes, looking for a recovery for housing, are looking at the wrong number. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

• AIA: Architecture Billings Index Downturn Moderates as Negative Conditions Continue in July

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index was at 48.7 in July, up from 45.9 in June. Anything below 50 indicates contraction in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index was at 48.7 in July, up from 45.9 in June. Anything below 50 indicates contraction in demand for architects' services.Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further weakness in CRE investment later this year and into next year (it will be some time before investment in offices and malls increases).

• Weekly Initial Unemployment Claims increased to 372,000

From the DOL: "In the week ending August 18, the advance figure for seasonally adjusted initial claims was 372,000, an increase of 4,000 from the previous week's revised figure of 368,000."

From the DOL: "In the week ending August 18, the advance figure for seasonally adjusted initial claims was 372,000, an increase of 4,000 from the previous week's revised figure of 368,000."The dashed line on the graph is the current 4-week average. The 4-week average post-bubble low is 363,000; this week the average was at 368,000.

This was above the consensus forecast of 365,000.

• Other Economic Stories ...

• FOMC Minutes: Discussion of policy tools the FOMC mioght use "fairly soon"

• From the Census Bureau: Durable Goods orders increase 4.2% in July

• From Zillow: Negative Equity Falls in Second Quarter; Nearly Half of Borrowers Under 40 Remain Underwater

• From the FHFA: U.S. House Prices Rose 1.8 Percent From First Quarter to Second Quarter 2012