by Calculated Risk on 9/04/2012 08:54:00 AM

Tuesday, September 04, 2012

CoreLogic: House Price Index increases in July, Up 3.8% Year-over-year

Notes: This CoreLogic House Price Index report is for July. The Case-Shiller index released last week was for June. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® July Home Price Index Rises 3.8 Percent Year-Over-Year—Biggest Increase Since 2006

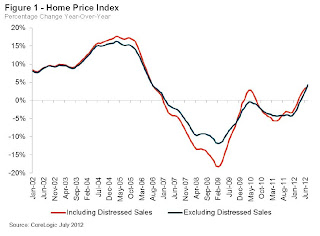

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 3.8 percent in July 2012 compared to July 2011. This was the biggest year-over-year increase since August 2006. On a month-over-month basis, including distressed sales, home prices increased by 1.3 percent in July 2012 compared to June 2012. The July 2012 figures mark the fifth consecutive increase in home prices nationally on both a year-over-year and month-over-month basis.

Excluding distressed sales, home prices nationwide increased on a year-over-year basis by 4.3 percent in July 2012 compared to July 2011. On a month-over-month basis excluding distressed sales, home prices increased 1.7 percent in July 2012 compared to June 2012, also the fifth consecutive month-over-month increase. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that August home prices, including distressed sales, will rise by 4.6 percent on a year-over-year basis from August 2011 and at least 0.6 percent on a month-over-month basis from July 2012.

“The housing market continues its positive trajectory with significant price gains in July and our expectation of a further increase in August,” said Mark Fleming, chief economist for CoreLogic. “While the pace of growth is moderating as we transition to the off-season for home buying, we expect a positive gain in price levels for the full year.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.3% in July, and is up 3.8% over the last year.

The index is off 27% from the peak - and is up 9.7% from the post-bubble low set in February (the index is NSA, so some of the increase is seasonal).

The second graph is from CoreLogic. The year-over-year comparison has been positive for five consecutive months.

The second graph is from CoreLogic. The year-over-year comparison has been positive for five consecutive months.Excluding the tax credit bump, these are the first year-over-year increases since 2006 - and this is the largest year-over-year increase since 2006.