by Calculated Risk on 9/09/2012 01:41:00 PM

Sunday, September 09, 2012

Employment Report Graphs: Participation Rate, Duration of Unemployment and Diffusion Indexes

Below are three more graphs based on the August employment report.

For more employment graphs and analysis, see:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

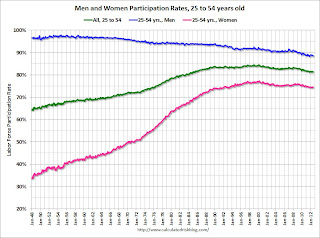

The following graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The participation rate for women increased significantly from the mid 30s to the mid 70s. This rate was at 75.5% prior to the recession, and declined to a post-recession low of 74.3%. There has been almost no recovery in the participation rate for prime working age women. This rate has mostly flattened out this year, and was still near the low in August at 74.5%.

The participation rate for men has decreased from the high 90s a few decades ago, to a low of 88.3% after the recession. This rate hasn't increased very much, and was at 88.5% in August.

There might be some "bounce back" for both men and women (some of the recent decline is probably cyclical), but the long term trend for men is down.

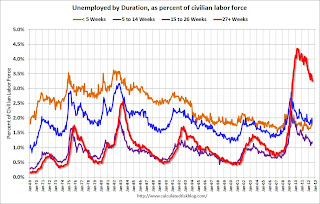

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 weeks, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 weeks, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.All categories are generally moving down, but there was an increase in the 'less than 5 weeks' and '15 to 26 weeks' categories in August.

Unfortunately the long term unemployed remains very high at 3.3% of the labor force in August, but this is the lowest percentage since 2009.

Diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. If there are employment gains, the more widespread, the better - even if job growth is slow. From the BLS:

Diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. If there are employment gains, the more widespread, the better - even if job growth is slow. From the BLS: Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The BLS diffusion index for total private employment was at 50.2 in August, down from 54.3 in July. For manufacturing, the diffusion index declined to 36.4 from 50.6 in July. This is the lowest level for manufacturing since 2009.

Not only was job growth was weak in August, but job gains were not widespread across industries (another negative).

Yesterday:

• Summary for Week Ending Sept 7th

• Schedule for Week of Sept 9th

• Analysis: I expect QE3 on Sept 13th