by Calculated Risk on 10/02/2012 09:16:00 PM

Tuesday, October 02, 2012

Wednesday: Apartment Vacancy Rate, ISM Service Index, ADP Employment

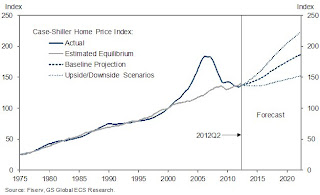

Goldman Sachs released a research note today on house prices: "House Price News Continues to Be Good". In the note, economists Hui Shan and Sven Jari Stehn provide some projections:

[W]e provide an upside and a downside scenario for house prices in addition to our baseline projection. ... We construct the upside and downside cases by incorporating both economic scenarios and modeling uncertainties. ... Although our methodology does not allow us to precisely estimate the probability of each constructed scenario, one can roughly consider the upside and downside as the one standard deviation above and below the baseline.

[Our] model now projects house price gains of 2.0% from mid-2012 to mid-2013, and 2.8% in the year thereafter (Exhibit 1). This baseline forecast is broadly in line with the latest consensus forecast. Exhibit 1 also shows our scenario analysis, pointing to house price appreciation of 9.1% (4.1% for 2012Q2-2013Q2 and 5.0% for 2013Q2-2014Q2) and -0.4% (-0.2% for 2012Q2-2013Q2 and -0.2% for 2013Q2-2014Q2) over the next two years, respectively, for the upside and downside alternative scenarios.

Click on graph for larger image.

Click on graph for larger image.Here is exhibit 1 from the research note showing Goldman's baseline forecast, and upside and downside scenarios.

On Wednesday:

• Early: Reis will release the Q3 2012 Apartment vacancy rates. Last quarter Reis reported that the apartment vacancy rate declined to 4.7% in Q2 from 4.9% in Q1 2012. This was the lowest vacancy rate since Q4 2001.

• At 7:00 AM, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Excerpt a surge in refinance activity with low mortgage rates.

• At 8:15 AM, the ADP Employment Report for September will be released. This report is for private payrolls only (no government). The consensus is for 140,000 payroll jobs added in August, down from the 201,000 reported last month.

• At 10:00 AM, the ISM non-Manufacturing Index for September will be released. The consensus is for a decrease to 53.5 from 53.7 in August. Note: Above 50 indicates expansion, below 50 contraction.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).