by Calculated Risk on 11/07/2012 06:56:00 PM

Wednesday, November 07, 2012

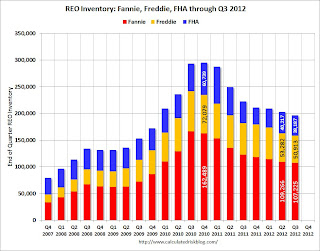

Fannie, Freddie, FHA REO inventory declines in Q3

First, from Fannie Mae: Fannie Mae Reports Net Income of $1.8 Billion for Third Quarter 2012

Fannie Mae (FNMA/OTC) today reported net income of $1.8 billion in the third quarter of 2012, compared with a net loss of $5.1 billion in the third quarter of 2011. For the first nine months of 2012, the company has reported $9.7 billion in net income. Lower credit-related expenses resulting from an increase in actual and expected home prices, higher sales prices on the company’s real-estate owned (“REO”) properties, and a decline in fair value losses contributed to the continued improvement in the company’s financial results.Here are some more details from the Fannie Mae's SEC filing 10-Q:

The company reported comprehensive income of $2.6 billion in the third quarter of 2012. The company is able to pay its third-quarter dividend of $2.9 billion to the Department of the Treasury without any draw under its senior preferred stock purchase agreement.

“We are seeing signs of sustained improvement in housing and our actions to support the housing recovery have generated strong financial results in 2012,” said Timothy J. Mayopoulos, president and chief executive officer.

Credit losses decreased in the third quarter and first nine months of 2012 compared with the third quarter and first nine months of 2011 primarily due to: (1) improved actual home prices and sales prices of our REO properties resulting from strong demand in markets with limited REO supply; and (2) lower volume of REO acquisitions due to the slow pace of foreclosures. The decrease in credit losses was partially offset by a decrease in amounts collected by us as a result of repurchase requests in the third quarter and first nine months of 2012 compared with the third quarter and first nine months of 2011. We expect our credit losses to remain high in 2012 relative to pre−housing crisis levels. We expect delays in foreclosures to continue for the remainder of 2012, which delays our realization of credit losses.Fannie sees rising prices and strong demand for REOs.

Click on graph for larger image.

Click on graph for larger image.This graph shows the REO inventory for Fannie, Freddie and the FHA. This was the seventh straight quarterly decline in the "F's" REO inventory, and total "F" REO was down 12% from a year ago.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions, VA and more. REO has been declining for those categories too. (I'll have more on those categories soon).