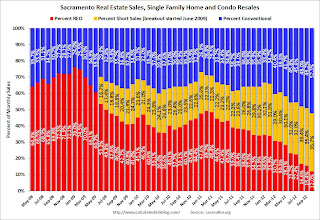

Recently there has been a dramatic shift from REO to short sales, and the percentage of distressed sales has been declining. This data would suggest some improvement in the Sacramento market.

In October 2012, 47.7% of all resales (single family homes and condos) were distressed sales. This was down from 50.8% last month, and down from 64.1% in October 2011. The is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs fell to 12.0%, the lowest since the Sacramento Realtors started tracking the data and the percentage of short sales increased to 35.7%, the highest percentage recorded.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image. This graph shows the percent of REO sales, short sales and conventional sales.

There has been an increase in conventional sales this year, and there were almost three times as many short sales as REO sales in October. The gap between short sales and REO sales is increasing.

Total sales were up 7% from October 2011, and conventional sales were up 55% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, but an increase in conventional sales.

Active Listing Inventory for single family homes declined 60.4% from last October, although listings were up 4% in October compared to the previous month.

Cash buyers accounted for 36.9% of all sales (frequently investors), and median prices were up 4.1% from last October.

This seems to be moving in the right direction, although the market is still in distress. We are seeing a similar pattern in other distressed areas to more conventional sales, and a shift from REO to short sales.