by Calculated Risk on 2/23/2013 01:11:00 PM

Saturday, February 23, 2013

Schedule for Week of Feb 24th

Earlier:

• Summary for Week Ending Feb 22nd

This will be a very busy week for economic data. The key reports are the January New Home sales report on Tuesday, the January Personal Income and Outlays report on Friday, and the second estimate of Q4 GDP on Thursday.

Other key reports include Case-Shiller house prices for December on Tuesday, the ISM manufacturing index on Friday, and auto sales also on Friday.

Fed Chairman Ben Bernanke will deliver the Semiannual Monetary Policy Report to the Senate on Tuesday, and to the House on Wednesday.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for February. The consensus is a decrease to 4.0 from 5.5 in January (above zero is expansion).

9:00 AM: FHFA House Price Index for December 2012. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase in house prices.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through November 2012 (the Composite 20 was started in January 2000).

The consensus is for a 6.8% year-over-year increase in the Composite 20 index (NSA) for December. The Zillow forecast is for the Composite 20 to increase 6.7% year-over-year, and for prices to increase 0.7% month-to-month seasonally adjusted.

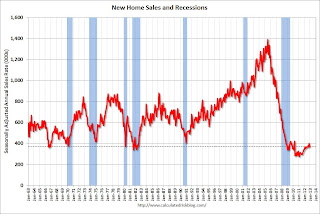

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the December sales rate.

The consensus is for an increase in sales to 381 thousand Seasonally Adjusted Annual Rate (SAAR) in January from 369 thousand in December.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February. The consensus is for a a reading of minus 3 for this survey, up from minus 12 in January (Below zero is contraction).

10:00 AM: Conference Board's consumer confidence index for February. The consensus is for the index to increase to 61.0.

10:00 AM: Fed Chairman Ben S. Bernanke, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 4.0% decrease in durable goods orders.

10:00 AM ET: Pending Home Sales Index for January. The consensus is for a 3.0% increase in the index.

10:00 AM: Fed Chairman Ben S. Bernanke, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 360 thousand from 362 thousand last week.

8:30 AM: Q4 GDP (second estimate). This is the second estimate of GDP from the BEA. The consensus is that real GDP increased 0.5% annualized in Q4, revised up from a negative 0.1% in the advance report.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a decrease to 55.0, down from 55.6 in January.

11:00 AM: Kansas City Fed regional Manufacturing Survey for February.

11:00 AM: The Federal Reserve Bank of New York will release the Q4 2012 Quarterly Report on Household Debt and Credit

8:30 AM ET: Personal Income and Outlays for January. The consensus is for a 2.1% decrease in personal income in January (following the surge in December due to some people taking income early to avoid higher taxes), and for 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for February). The consensus is for a reading of 76.0.

10:00 AM ET: ISM Manufacturing Index for February.

10:00 AM ET: ISM Manufacturing Index for February. Here is a long term graph of the ISM manufacturing index. The ISM manufacturing index indicated expansion in January at 53.1% (dashed line). The employment index was at 54.0%, and the new orders index was at 53.3%. The consensus is for PMI to be decline to 52.8%. (above 50 is expansion).

10:00 AM: Construction Spending for January. The consensus is for a 0.6% increase in construction spending.

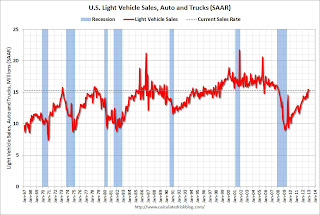

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be at 15.2 million SAAR in February (Seasonally Adjusted Annual Rate) down from 15.3 SAAR in January.

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be at 15.2 million SAAR in February (Seasonally Adjusted Annual Rate) down from 15.3 SAAR in January.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.