by Calculated Risk on 3/27/2013 02:31:00 PM

Wednesday, March 27, 2013

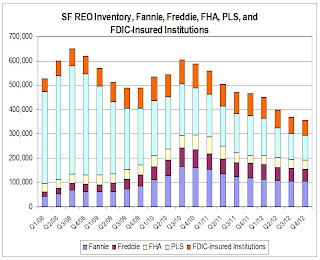

Lawler: Single Family REO inventories down 23.4% in 2012

From economist Tom Lawler:

While Fannie Mae still hasn’t released its 2012 10-K, FHFA released its quarterly “Foreclosure Prevention Report” for Q4/2012, which includes data on foreclosure prevention activity, foreclosures, short sales/DILs, loan modifications, credit performance, and Real Estate Owned (REO) activity at Fannie Mae and Freddie Mac. ...

Here is a chart showing the SF REO Inventory of Fannie, Freddie, FHA, Private-Label Securities, and FDIC-Insured Institutions. For the latter, I assume that the average carrying value is 50% higher than that of the average for Fannie and Freddie.

Click on graph for larger image.

Click on graph for larger image.

SF REO inventories for these combined sectors were down 23.4% in 2012.

CR Note: Total REO is about half the level in 2008. In 2008 most of the REO was Private-Label Securities. The peak in 2010 was related to more foreclosure activity at Fannie, Freddie and the FHA.

The second graph is for just Fannie, Freddie and the FHA REO.

REO at the "Fs" peaked in 2010, and is down about 35% since then.

REO at the "Fs" peaked in 2010, and is down about 35% since then.