by Calculated Risk on 4/29/2013 04:56:00 PM

Monday, April 29, 2013

Q1 2013 GDP Details: Single Family investment increases, Commercial Investment very Low

The BEA released the underlying details for the Q1 advance GDP report today.

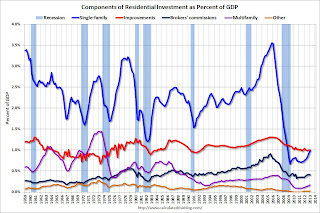

The first graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

A few key points:

1) Usually the most important components are investment in single family structures followed by home improvement. However home improvement has been the top category for eighteen consecutive quarters, but that is about to change. Investment in single family structures should be the top category again by Q2 or Q3.

2) Even though investment in single family structures has increased significantly from the bottom, single family investment is still very low - and still below the bottom for previous recessions. I expect further increases over the next few years.

3) Look at the contribution from Brokers' commissions. This is the category related to existing home sales (this is the contribution to GDP from existing home sales). If existing home sales are flat, or even decline due to fewer foreclosures, this will have little impact on residential investment.

Click on graph for larger image.

Click on graph for larger image.

Investment in home improvement was at a $161 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (about 1.0% of GDP), still above the level of investment in single family structures of (corrected) $157 billion (SAAR) (or 0.98% of GDP). Single family structure investment will probably overtake home improvement as the largest category of residential investment next quarter.

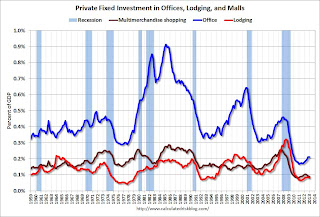

The second graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased slightly, but from a very low level.

Investment in offices is down about 54% from the recent peak (as a percent of GDP). With the high office vacancy rate, investment will probably not increase significantly (as a percent of GDP) for several years - even though there has been some increase in the Architecture Billings Index lately.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 65% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 65% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment peaked at 0.32% of GDP in Q2 2008 and is down about 75%. With the hotel occupancy rate close to normal, it is possible that hotel investment will increase this year.

These graphs show there is currently very little investment in offices, malls and lodging. And residential investment is starting to pickup, but from a very low level.