by Calculated Risk on 4/20/2013 12:45:00 PM

Saturday, April 20, 2013

Summary for Week ending April 19th

According to the Fed's Beige book released last week, "economic activity expanded at a moderate pace" recently with housing leading the way. That is reflected in the data released.

Housing starts were at the highest level since June 2008. The monthly increase was a related to a surge in multi-family starts (there is significant month-to-month variability in multi-family starts), however single family starts were up 28.7% year-over-year, a strong increase too. And even with the recent increase in starts, housing starts - especially single family starts - are still low, and we will probably see continued growth over the next few years. Since residential investment is usually the best leading indicator for the economy, this suggests the economy will continue to grow over the next couple of years.

Of course manufacturing is seeing more sluggish growth (as reflected in the Empire State and Philly Fed manufacturing surveys for April). And initial weekly unemployment claims have increased recently - perhaps related to the sequestration budget cuts.

But overall the data suggests continued growth.

Here is a summary of last week in graphs:

• Housing Starts increased to 1.036 million SAAR in March

Click on graph for larger image.

Click on graph for larger image.

From the Census Bureau: Permits, Starts and Completions "Privately-owned housing starts in March were at a seasonally adjusted annual rate of 1,036,000. This is 7.0 percent above the revised February estimate of 968,000 and is 46.7 percent above the March 2012 rate of 706,000.

Single-family housing starts in March were at a rate of 619,000; this is 4.8 percent below the revised February figure of 650,000. The March rate for units in buildings with five units or more was 392,000."

This was well above expectations of 930 thousand starts in March, mostly due to the sharp increase in multi-family starts - and the highest level since June 2008. Starts in March were up 46.7% from March 2012; single family starts were up 28.7% year-over-year. Starts in February were revised up sharply. This was a strong report.

• Fed: Industrial Production increased 0.4% in March

From the Fed: Industrial production and Capacity Utilization

From the Fed: Industrial production and Capacity Utilization

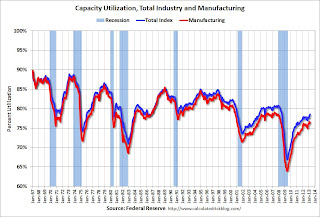

"Industrial production rose 0.4 percent in March after having increased 1.1 percent in February. ... The rate of capacity utilization for total industry moved up in March to 78.5 percent, a rate that is 1.2 percentage points above its level of a year earlier but 1.7 percentage points below its long-run (1972--2012) average."

This graph shows Capacity Utilization. This series is up 11.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.5% is still 1.7 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.8% in December 2007.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.

Industrial production increased in March to 99.5. This is 18.8% above the recession low, but still 1.3% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were above expectations.

• NMHC Apartment Survey: Market Conditions Tighten in April

From the National Multi Housing Council (NMHC): Apartment Markets Resume Growth According to NMHC Survey "Market Tightness Index rose to 54 from 45."

From the National Multi Housing Council (NMHC): Apartment Markets Resume Growth According to NMHC Survey "Market Tightness Index rose to 54 from 45."

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. This quarterly increase was small, but indicates tighter market conditions.

On supply: Even though multifamily starts have been increasing, completions lag starts by about a year - so the builders are still trying to catch up. There will be many more completions in 2013 and 2014, than in 2012, increasing the supply.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. This survey now suggests vacancy rates might be nearing a bottom, although apartment markets are still tight, so rents will probably continue to increase.

• Key Measures show low inflation in March

This graph shows the year-over-year change for these four key measures of inflation: median CPI, trimmed-mean CPI, CPI less food and energy, and core PCE prices. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.9%. Core PCE is for January and increased 1.3% year-over-year.

This graph shows the year-over-year change for these four key measures of inflation: median CPI, trimmed-mean CPI, CPI less food and energy, and core PCE prices. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.9%. Core PCE is for January and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 1.1% annualized, trimmed-mean CPI was at 0.7% annualized, and core CPI increased 1.3% annualized. Also core PCE for February increased 0.7% annualized.

With this low level of inflation and the current high level of unemployment, I expect the Fed will continue the large scale asset purchases (QE) at the current level.

• New York and Philly Fed Manufacturing Surveys Show Slower Expansion in April

From the NY Fed: Empire State Manufacturing Survey "Manufacturing Survey indicates that conditions for New York manufacturers improved slightly. The general business conditions index fell six points but, at 3.1, remained positive for a third consecutive month." This suggests some expansion, but was below the consensus forecast of a reading of 7.5.

From the NY Fed: Empire State Manufacturing Survey "Manufacturing Survey indicates that conditions for New York manufacturers improved slightly. The general business conditions index fell six points but, at 3.1, remained positive for a third consecutive month." This suggests some expansion, but was below the consensus forecast of a reading of 7.5.

From the Philly Fed: April Manufacturing Survey "The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, was 1.3, just slightly lower than the reading of 2.0 in March."

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through April. The ISM and total Fed surveys are through March.

The average of the Empire State and Philly Fed surveys decreased in April, but remained positive for the 2nd consecutive month after indicating contraction for 9 straight months. This suggests the ISM manufacturing index will show further expansion in April.

• Weekly Initial Unemployment Claims increase to 352,000

The DOL reports: "In the week ending April 13, the advance figure for seasonally adjusted initial claims was 352,000, an increase of 4,000 from the previous week's revised figure of 348,000. The 4-week moving average was 361,250, an increase of 2,750 from the previous week's revised average of 358,500."

The DOL reports: "In the week ending April 13, the advance figure for seasonally adjusted initial claims was 352,000, an increase of 4,000 from the previous week's revised figure of 348,000. The 4-week moving average was 361,250, an increase of 2,750 from the previous week's revised average of 358,500."

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 361,250 - the highest level since January.

Weekly claims were above the 347,000 consensus forecast.