by Calculated Risk on 5/03/2013 10:00:00 AM

Friday, May 03, 2013

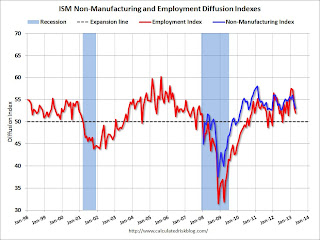

ISM Non-Manufacturing Index indicates slower expansion in April

Note: I'll have much more on the employment report soon.

The April ISM Non-manufacturing index was at 53.1%, down from 54.4% in March. The employment index decreased in April to 52.0%, down from 53.3% in March. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: April 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in April for the 40th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 53.1 percent in April, 1.3 percentage points lower than the 54.4 percent registered in March. This indicates continued growth at a slightly slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 55 percent, which is 1.5 percentage points lower than the 56.5 percent reported in March, reflecting growth for the 45th consecutive month. The New Orders Index decreased by 0.1 percentage point to 54.5 percent, and the Employment Index decreased 1.3 percentage points to 52 percent, indicating growth in employment for the ninth consecutive month. The Prices Index decreased 4.7 percentage points to 51.2 percent, indicating prices increased at a slower rate in April when compared to March. According to the NMI™, 14 non-manufacturing industries reported growth in April. Respondents' comments remain mostly positive about business conditions. Cost management and revenue pressures are areas of concern for many of the respective companies."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 54.0% and indicates slower expansion in April than in March.