by Calculated Risk on 5/16/2013 10:08:00 AM

Thursday, May 16, 2013

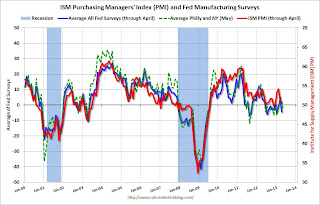

Philly Fed Manufacturing Survey Shows Contraction in May

Note: I'll have more on housing starts and inflation later ...

From the Philly Fed: May Manufacturing Survey

Manufacturing firms responding to the monthly Business Outlook Survey suggest that regional manufacturing activity weakened this month. All of the survey’s broadest current indicators were negative this month, indicating weaker conditions compared with April. The survey’s indicators of future activity improved, however, and suggest that firms expect overall growth over the next six months.Earlier in the week, the Empire State manufacturing survey also indicated contraction in May.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 1.3 in April to -5.2 this month. The current activity index has shown no pattern of sustained growth over the past seven months, generally alternating between positive and negative readings.

Labor market conditions showed continued weakness, with indexes suggesting lower employment overall. The employment index decreased 2 points to -8.7, its second consecutive negative reading. ... The workweek index declined 10 points to -12.4, remaining negative for the fifth consecutive month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through May. The ISM and total Fed surveys are through April.

The average of the Empire State and Philly Fed surveys turned negative again in May. This suggests another weak ISM report.