Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates easing along with market concerns over the Federal Reserve's bond purchase program ...

30-year fixed-rate mortgage (FRM) averaged 4.37 percent with an average 0.7 point for the week ending July 18, 2013, down from last week when it averaged 4.51 percent. Last year at this time, the 30-year FRM averaged 3.53 percent.

15-year FRM this week averaged 3.41 percent with an average 0.7 point, down from last week when it averaged 3.53 percent. A year ago at this time, the 15-year FRM averaged 2.83 percent.

Click on graph for larger image.

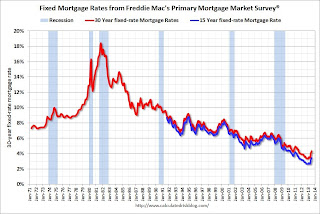

Click on graph for larger image.This graph shows the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

30 year mortgage rates are up from 3.35% in early May, and 15 year mortgage rates are up from 2.56% over the last 2 months.

The Freddie Mac survey started in 1971.

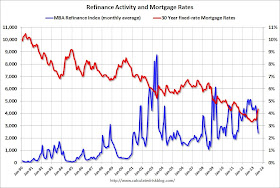

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index. The refinance index has dropped sharply recently (down 55% over the last 10 weeks) and will continue to decline if rates stay at this level.