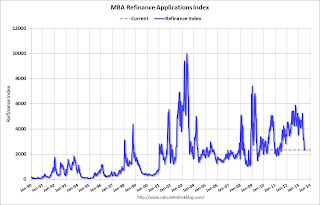

The Refinance Index decreased 1 percent from the previous week driven by a 12 percent drop in the Government Refinance index while the Conventional Refinance index rose by 2 percent. The Refinance Index is at the lowest level since July 2011. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier.

...

The refinance share of mortgage activity remained unchanged at 63 percent of total applications.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.58 percent from 4.68 percent, with points decreasing to 0.40 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates above 4.5%, refinance activity has fallen sharply, decreasing in 10 of the last 11 weeks.

This index is down 55% over the last eleven weeks.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the last several weeks), and the 4-week average of the purchase index is up about 6% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the last several weeks), and the 4-week average of the purchase index is up about 6% from a year ago.