RealtyTrac® ... today released its Midyear 2013 U.S. Foreclosure Market Report™, which shows a total of 801,359 U.S. properties with foreclosure filings — default notices, scheduled auctions and bank repossessions — in the first half of 2013, a 19 percent decrease from the previous six months and down 23 percent from the first half of 2012.

...

A total of 127,790 U.S. properties had foreclosure filings in June, down 14 percent from the previous month and down 35 percent from a year ago to the lowest monthly level since December 2006 — a six and a half year low.

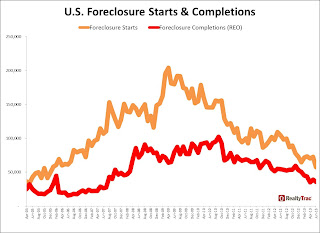

U.S. foreclosure starts in June dropped 21 percent from the previous month and were down 45 percent from a year ago to the lowest monthly level since December 2005 — a seven and a half year low. Year to date through June, 409,491 foreclosure starts have been filed nationwide, on pace to reach more than 800,000 for the year, which would be down from 1.1 million foreclosure starts in 2012.

...

Judicial foreclosure auctions (NFS) were scheduled for 28,296 U.S. properties in June, up less than 1 percent from May but up 34 percent from June 2012. States with substantial annual increases in scheduled judicial foreclosure auctions included New Jersey (up 103 percent), Florida (up 100 percent), Maryland (up 94 percent), New York (up 66 percent), and Illinois (up 65 percent to a 35-month high).

...

“Halfway through 2013 it is becoming increasingly evident that while foreclosures are no longer a problem nationally they continue to be a thorn in the side of several state and local markets, particularly where a backlog of delayed distress has built up thanks to a lengthy foreclosure process,” said Daren Blomquist, vice president at RealtyTrac. “The increases in judicial foreclosure auctions demonstrate that these delayed foreclosure cases are now being moved more quickly through to foreclosure completion.

Click on graph for larger image.

Click on graph for larger image.This graph from RealtyTrac shows foreclosure starts and completions since 2005.

Some of the decline in foreclosure activity is related to the increased emphasis on short sales and modifications.

The difference in various states is another reminder that a national foreclosure law, with strong borrower protections, should be part of the housing finance reform legislation.