by Calculated Risk on 8/09/2013 12:59:00 PM

Friday, August 09, 2013

Update: When will payroll employment exceed the pre-recession peak?

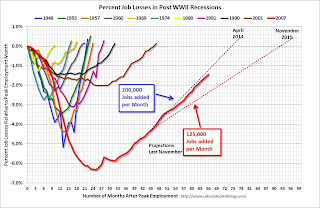

About two years ago I posted a graph with projections of when payroll employment would return to pre-recession levels (see: Sluggish Growth and Payroll Employment from November 2011).

In 2011, I argued we'd continue to see sluggish growth (back in 2011 many analysts were forecasting another US recession - those forecasts were wrong).

On the graph I posted two lines - one with payroll growth of 125,000 payroll jobs added per month (the pace in 2011), and another line with 200,000 payroll jobs per month. The following graph is an update with reported payroll growth through July 2013.

The dashed red line is 125,000 payroll jobs added per month. The dashed blue line is 200,000 payroll jobs per month. Both projections are from November 2011.

Click on graph for larger image.

Click on graph for larger image.

So far the economy has tracked fairly closely to the blue line (200,000 payroll jobs per month).

Right now it appears payrolls will exceed the pre-recession peak in early to mid-2014.

Currently there are about 2 million fewer payroll jobs than before the recession started, and at the recent pace of job growth it will take another 11 months to reach the previous peak. Note: I expect another upward adjustment when the annual benchmark revision is released in January, so we will probably reach the previous peak in fewer than 11 months.

Of course this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow).

Note: There are 1.482 million fewer private sector payroll jobs than before the recession started. At the recent pace of private sector job growth - plus a positive benchmark revision in January - we could be back at the pre-recession peak early in 2014.