CoreLogic ... today released new analysis showing approximately 2.5 million more residential properties returned to a state of positive equity during the second quarter of 2013, and the total number of mortgaged residential properties with equity currently stands at 41.5 million. The analysis shows that 7.1 million homes, or 14.5 percent of all residential properties with a mortgage, were still in negative equity at the end of the second quarter of 2013. This figure is down from 9.6 million homes, or 19.7 percent of all residential properties with a mortgage, at the end of the first quarter of 2013

... Of the 41.5 million residential properties with positive equity, 10.3 million have less than 20 percent equity. Borrowers with less than 20 percent equity, referred to as “under-equitied,” may have a more difficult time obtaining new financing for their homes due to underwriting constraints. Under-equitied mortgages accounted for 21.1 percent of all residential properties with a mortgage nationwide in the second quarter of 2013. At the end of the second quarter of 2013, 1.7 million residential properties had less than 5 percent equity, referred to as near-negative equity. Properties that are near negative equity are at risk should home prices fall. ...

“Equity rebuilding continued in the second quarter of this year as the share of underwater mortgaged homes fell to 14.5 percent,” said Dr. Mark Fleming, chief economist for CoreLogic. “In just the first half of 2013 almost three and a half million homeowners have returned to positive equity, but the pace of improvement will likely slow as price appreciation moderates in the second half.”

emphasis added

Click on graph for larger image.

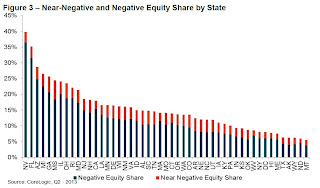

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 36.4 percent, followed by Florida (31.5 percent), Arizona (24.7 percent), Michigan (22.5 percent), and Georgia (20.7 percent). These top five states combined account for 34.9 percent of negative equity in the U.S."

The second graph shows the distribution of home equity in Q2 compared to Q1. Under 6% of residential properties have 25% or more negative equity, down from over 8% in Q1. It will be long time before those borrowers have positive equity.

The second graph shows the distribution of home equity in Q2 compared to Q1. Under 6% of residential properties have 25% or more negative equity, down from over 8% in Q1. It will be long time before those borrowers have positive equity.But many other borrowers are close (less than 10% negative equity).