by Calculated Risk on 11/21/2013 10:00:00 AM

Thursday, November 21, 2013

Philly Fed Manufacturing Survey indicates Slower Expansion in November

From the Philly Fed: November Manufacturing Survey

Manufacturing growth in the region continued in November but did not match the pace of growth in the preceding month, according to firms responding to this month’s Business Outlook Survey. The survey’s broadest indicators for general activity, new orders, shipments, and employment were positive, signifying growth, but readings for each fell from October. The survey's indicators of future activity also moderated but continue to suggest general optimism about growth over the next six months.This was below the consensus forecast of a reading of 15.5 for November.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, declined from 19.8 in October to 6.5 this month. The index has now been positive for six consecutive months.

Labor market indicators showed little improvement this month. The current employment index fell 14 points from its reading in October (which was at a two-year high), to 1.1.

emphasis added

Click on graph for larger image.

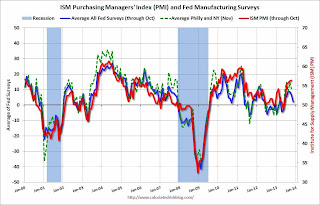

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through November. The ISM and total Fed surveys are through October.

The average of the Empire State and Philly Fed surveys has been positive for six consecutive months. This suggests slower expansion in the ISM report for November.

Also Market released their Flash PMI for November this morning that suggests faster manufacturing expansion:

At 54.3, the Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™)1, which is based on approximately 85% of usual monthly survey replies, rose to an eight-month high in November. This was up from a one-year low of 51.8 in October.