by Calculated Risk on 11/07/2013 09:18:00 AM

Thursday, November 07, 2013

Q3 GDP: Growth slightly above Expectations, but Weak Personal consumption expenditures

The advance Q3 GDP report, with 2.8% annualized growth, was above expectations. However some of the details were weak. Personal consumption expenditures (PCE) increased at a 1.5% annualized rate - the slowest rate since Q2 2011.

"Change in private inventories" added 0.83 percentage points to GDP in Q3. This was above expectations of a 2.0% growth rate, but mostly because of inventories.

It appears that the drag from state and local governments has ended, although the drag from Federal government spending is ongoing. The Federal government subtracted 0.13 percentage points in Q3, whereas state and local governments added 0.17 percentage points.

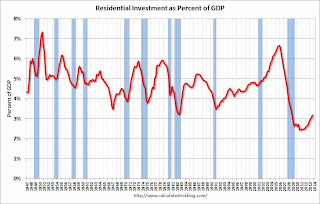

Residential investment (RI) remains a bright spot (increasing at a 14.6% annualized rate), and RI as a percent of GDP is still very low - and I expect RI to continue to increase over the next few years.

The first graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 12 quarters (through Q3 2013).

And the drag from state and local governments appears to have ended after an unprecedented period of state and local austerity (not seen since the Depression). State and local governments have added to GDP for two quarters now.

I expect state and local governments to continue to make small positive contributions to GDP going forward.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units. Clearly RI has bottomed, but it still below the levels of previous recessions.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units. Clearly RI has bottomed, but it still below the levels of previous recessions.

I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

I'll add details for investment in offices, malls and hotels next week.

The key story is that residential investment is continuing to increase, and I expect this to continue. Since RI is the best leading indicator for the economy, this suggests no recession in the near future (with the usual caveats about Congress).

Finally, real GDP has increased only 1.6% over the last year (Q3 2012 to Q3 2013). Because GDP growth was very weak in Q4 2012, it will only take 1.5% annualized growth in Q4 to reach the lower end of the Fed's GDP target.