As of the third quarter, smaller mortgage players held a 60% market share of the U.S. origination market, up from 39% in 2009, according to industry publication Inside Mortgage Finance.This shift in market share has possible implications for the MBA purchase index. Back in 2007, the MBA index started to increase - and some observers like Alan Greenspan thought this meant the housing bust was over. I pointed out back then that the index was being distorted by a shift from smaller lenders to larger lenders (the smaller lenders were going out of business). The MBA index includes many lenders, but is skewed towards the larger lenders.

...

The midsize and smaller players have grown despite tightening their underwriting standards, much like larger banks have since the financial crisis. But the smaller banks' capital rules aren't as stringent as those that make mortgages a costly enterprise for the biggest firms.

Now the index is probably understating the activity in the market - because there is a market shift from large lenders to smaller lenders.

From the MBA: Mortgage Applications Fall During Holiday-Shortened Week

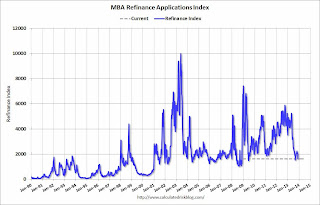

Mortgage applications decreased 12.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 29, 2013. This week’s results include an adjustment for the Thanksgiving holiday. ...

The Refinance Index decreased 18 percent from the previous week and is at its lowest level since the week ending September 6, 2013. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.51 percent from 4.48 percent, with points increasing to 0.38 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down sharply - and down 69% from the levels in early May.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 8% from a year ago.