The key report this week will be retail sales for November.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

7:30 AM ET: NFIB Small Business Optimism Index for November.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS.

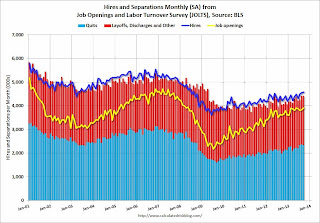

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in September to 3.913 million from 3.844 million in August. The number of job openings (yellow) is up 8.6% year-over-year compared to September 2012 and openings are at the highest level since early 2008.

Quits were mostly unchanged in September and are up about 18% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for October. The consensus is for a 0.4% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 325 thousand from 298 thousand last week.

8:30 AM ET: Retail sales for November will be released.

8:30 AM ET: Retail sales for November will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 29.1% from the bottom, and now 13.2% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to be 0.6% in November, and to increase 0.3% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for October. The consensus is for a 0.3% increase in inventories.

8:30 AM: Producer Price Index for November. The consensus is for a 0.1% decrease in producer prices (and 0.1% increase in core PPI).