by Calculated Risk on 12/08/2013 09:55:00 AM

Sunday, December 08, 2013

Update: Four Charts to Track Timing for QE3 Tapering

Here is an update of the four charts I'm using to track when the Fed will start tapering QE3 purchases.

In general the year-end data might be "broadly consistent" with the June (and September) FOMC projections.

However I suspect the FOMC is very concerned about the low level of inflation, and also the decline in the employment participation rate.

The December FOMC meeting is on the 17th and 18th. Note: Another key is that a budget agreement is reached by December 13th.

Click on graph for larger image.

Click on graph for larger image.

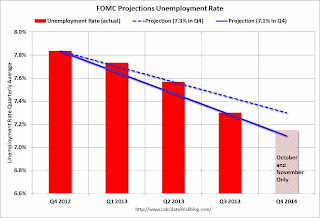

The first graph is for the unemployment rate.

The current forecast is for the unemployment rate to decline to 7.1% to 7.3% in Q4 2013.

We only have data through November, but it is pretty clear that the unemployment rate is tracking the FOMC forecast (lower is better).

However, in July, Bernanke said that the unemployment rate "probably understates the weakness of the labor market." He suggested he is watching other employment indicators too, and I suspect the FOMC will also discuss the decline in the participation rate.

The second graph is for GDP.

The second graph is for GDP.

The current forecast is for GDP to increase between 2.0% and 2.3% (the FOMC revised down their forecast from 2.3% and 2.6% in June). This is the increase in GDP from Q4 2012 to Q4 2013.

Currently GDP is tracking the FOMC forecasts, and real GDP only has to increase 0.8% annualized in Q4 to reach the lower forecast. Even with a negative contribution from inventories in Q4, it appears GDP will meet the lower forecast.

The third graph is for PCE prices.

The current forecast is for prices to increase 1.1% to 1.2% from Q4 2012 to Q4 2013. This was revised up from 0.8% to 1.2% in June.

The current forecast is for prices to increase 1.1% to 1.2% from Q4 2012 to Q4 2013. This was revised up from 0.8% to 1.2% in June.

We only have data through October, but so far PCE prices are below this projection - and this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup, and a key is if the recent decline in inflation is "transitory".

The fourth graph is for core PCE prices

The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

Through October core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%.