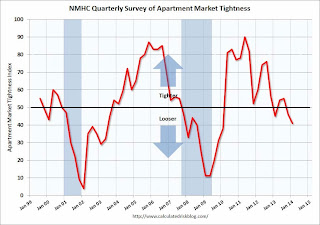

Apartment market conditions weakened a bit in January compared with three months earlier. The market tightness (41), sales volume (41) and debt financing (42) indexes were all a little below the breakeven level of 50, although the equity financing index rebounded to 50.

“Apartment markets are little changed from October,” said Mark Obrinsky, NMHC’s Senior Vice President for Research and Chief Economist. “At least half of our respondents to each of our four main questions reported conditions as unchanged from three months earlier. Although markets are a little looser than in October, this is largely seasonal; overall markets remain fairly tight.

“New supply is finally starting to arrive at levels that will more closely match overall demand. In a few markets, we are seeing completions a little higher than absorptions, but this is likely to be short term in nature. Fundamentally, demand for apartment homes should be strong for the rest of the decade (and beyond) – provided only that the economy remains on track.”

...

The Market Tightness Index declined to 41 from 46. Slightly more than half (56 percent) of respondents reported unchanged conditions, and approximately one-third (31 percent) saw conditions as looser than three months ago. The index last indicated overall improving conditions in July 2013. Some respondents noted that the decline was typical for this time of year and that conditions remain fairly tight.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates loosening from the previous quarter. The quarterly decrease was small, but indicates looser market conditions.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. This survey now suggests vacancy rates are near a bottom.