by Calculated Risk on 2/19/2014 09:55:00 AM

Wednesday, February 19, 2014

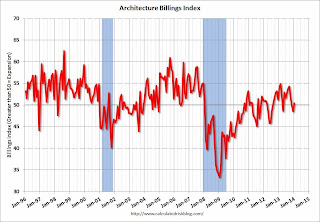

AIA: Architecture Billings Index increases slightly in January

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Slight Rebound for Architecture Billings Index

ter consecutive months of contracting demand for design services, there was a modest uptick in the Architecture Billings Index (ABI). As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the January ABI score was 50.4, up from a mark of 48.5 in December. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.5, down a bit from the reading of 59.2 the previous month.

“There is enough optimism in the marketplace that business conditions should return to steady growth as the year progresses,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “The suspension of the debt ceiling should ease some anxiety around projects for the federal government, at least for the time being. However, private sector spending should lead the construction upturn this year, which will depend more on employment growth and continued improvement in the overall economy."

Regional averages: South (53.5),West (51.1), Midwest (46.5), Northeast (43.6) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.4 in January, up from 48.5 in December. Anything above 50 indicates expansion in demand for architects' services. This index has indicated expansion during 15 of the last 18 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. Even when positive, this index was not as strong as during the '90s - or during the bubble years of 2004 through 2006 - because the vacancy rates are still high for many CRE sectors. However, the readings over the last year suggest some increase in CRE investment in 2014.