by Calculated Risk on 2/18/2014 02:14:00 PM

Tuesday, February 18, 2014

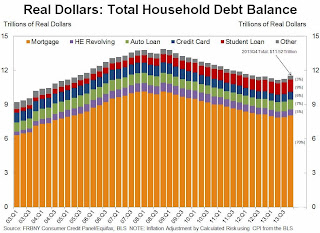

Real Household Debt down 17% from Peak, Real Mortgage Debt down 21%

This morning, the NY Fed released their Q4 Household Debt and Credit Report. The report showed that total household debt is 9.1% below the Q3 2008 peak. Mortgage debt is down 13.4% from the peak, and Home Equity revolving debt is down 25.9%. This is nominal dollars.

If we look at real dollars (inflation adjusted using CPI from the BLS), then total debt is down 16.9% since 2008, mortgage debt down 20.7%, home equity debt down 32.6%, auto debt down 12.2%, and credit card debt down 27.9%. Only student debt is at a new high (up 77% since Q3 2008 in nominal terms).

The following graph (not from the NY Fed) shows household debt in real terms.

Click on graph for larger image.

Click on graph for larger image.

This household deleveraging was a key reason the recovery was slow, and now it appears the deleveraging is over.

This is a significant decline in total household debt, especially for mortgage, home equity, and credit card debt (student debt has increased).