by Calculated Risk on 2/22/2014 12:51:00 PM

Saturday, February 22, 2014

Schedule for Week of Feb 23rd

The key reports this week are the second estimate of Q4 GDP on Friday, January New Home sales on Wednesday, and December Case-Shiller house prices on Tuesday.

For manufacturing, the February Dallas, Richmond and Kansas City Fed surveys will be released.

Note: The FDIC is expected to release the Q4 FDIC Quarterly Banking Profile during the week.

Also Fed Chair Janet Yellen will provide the Semiannual Monetary Policy Report to the Congress on Thursday.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for February.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December.

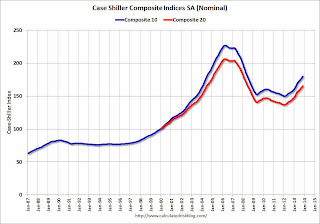

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through November 2012 (the Composite 20 was started in January 2000).

The consensus is for a 13.3% year-over-year increase in the Composite 20 index (NSA) for December. The Zillow forecast is for the Composite 20 to increase 13.5% year-over-year, and for prices to increase 0.7% month-to-month seasonally adjusted.

9:00 AM: FHFA House Price Index for December 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

9:00 AM: Chemical Activity Barometer (CAB) for January from the American Chemistry Council. This appears to be a leading economic indicator.

10:00 AM: Conference Board's consumer confidence index for February. The consensus is for the index to decrease to 80.0 from 80.7.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the December sales rate.

The consensus is for a decrease in sales to 405 thousand Seasonally Adjusted Annual Rate (SAAR) in January from 414 thousand in December.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 336 thousand.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.0% decrease in durable goods orders.

10:00 AM: Testimony, Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

11:00 AM: the Kansas City Fed manufacturing survey for February. This is the last of the regional Fed surveys for February.

8:30 AM: Q4 GDP (second estimate). This is the second estimate of Q4 GDP from the BEA. The consensus is that real GDP increased 2.5% annualized in Q4, revised down from the advance estimate of 3.2%.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a decrease to 57.8, down from 59.6 in January.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for February). The consensus is for a reading of 81.2, unchanged from the preliminary reading of 81.2, and unchanged from the January reading.

10:00 AM ET: Pending Home Sales Index for January. The consensus is for a 2.7% increase in the index.